Spread Betting: Tax-Free Trading at Your Fingertips

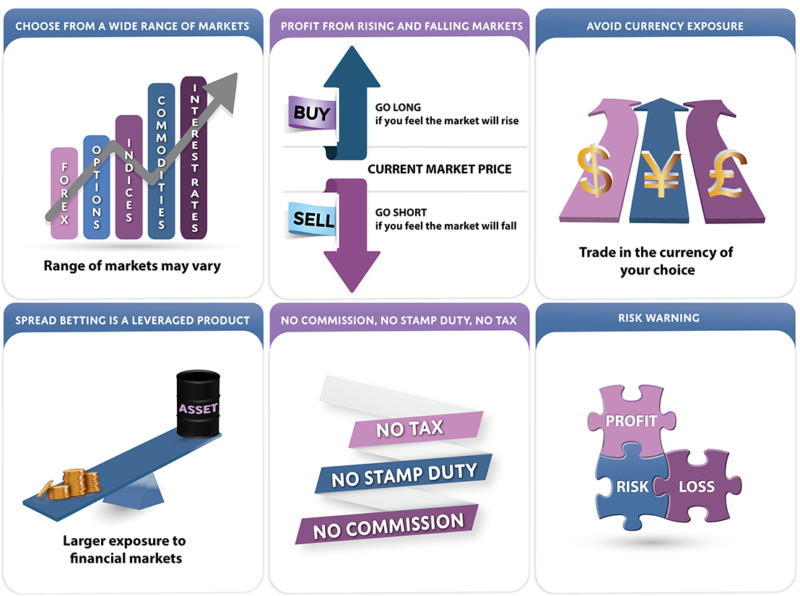

Spread betting represents a low-cost way to trade, deploying inherent leverage and low trading costs to provide a more efficient way of trading in shares, commodities, currencies, indices, and a variety of other markets absolutely tax-free.

The medium of spread betting works entirely differently from most other trading styles and has a number of innovative and unique quirks that set it apart from more conventional instruments. It is not so much an investment as a speculation, calling a particular direction in the movement of a market to profit directly from the broker. Simplicity and low capital requirements make it a popular choice amongst traders in the UK and Ireland.

Spread Betting in a Nutshell

What Is Spread Betting?

Spread betting is the process of trading on markets, rather than trading in markets. A spread trade is essentially nothing more than a bet (hence the terminology of spread ‘betting’), or perhaps more accurately a contract made with a spread betting broker on the future movement of an underlying market as contrasted with today’s prices.

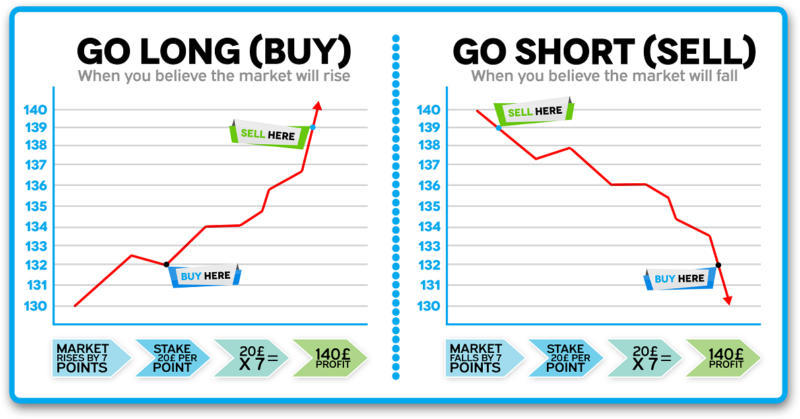

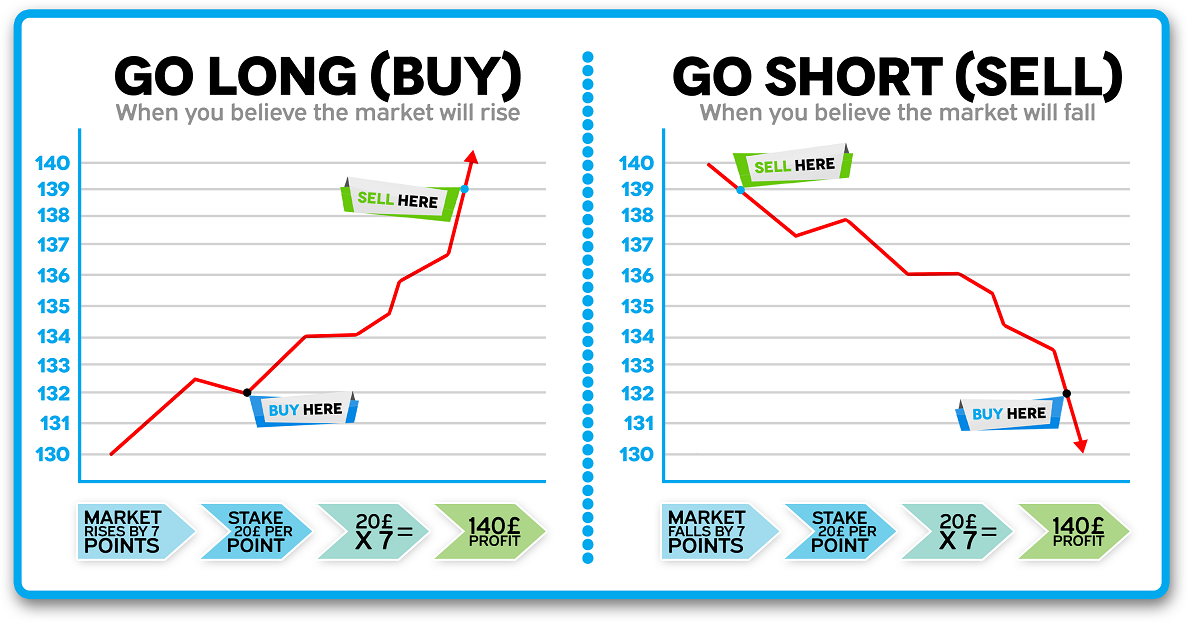

Traders pick a direction of market movement – either up or down, known as ‘buying’ and ‘selling’ – and place a stake per point on the trade. For every 1 point the market rises beyond the buy price in ‘long’ trades (i.e. those trades that predict a rise in the market), the trader earns an additional multiple of their stake. For every 1 point that moves against the trader however, his liability increases by an additional multiple, thus the liability of a particular trade isn’t limited to the amount of the original stake.

This process of adding and subtracting multiples is primarily what attracts traders to spread betting. While spread betting is in practice quite distinct from gambling, the returns that can be afforded by spread betting are easily comparable, thanks to this multiplying effect – known as ‘leverage’.

Leverage is arguably the most central feature of spread betting, and the one highlight that makes it so popular. Because markets can move by a wide range of points over the space of a day, immediate returns can run into the tens of percent, and despite the comparatively massive risk profile, these rewards are still hard to beat elsewhere.

How Is Spread Betting Different?

| Features | Spread Betting | CFDs | Share Trading |

|---|---|---|---|

| Tax | No Capital Gains Tax, no income tax, no stamp duty | Subject to CGT, no stamp duty | Subject to CGT and stamp duty |

| Go Long/Short | Yes | Yes | Buy only |

| Leveraged | Yes | Yes | No |

| Commission | No | Yes | Yes |

| Good for Long-Term? | No | No | Yes |

| Markets | Wide range of markets | Wide range of markets | Shares only |

| Currency | GBP (or currency of your choice £/$/€) | Currency of the underlying asset | Currency of the shares |

| Regional Availability | UK and Ireland | Global (restrictions apply) | Global (restrictions apply) |

Explore the basics of spread betting, key concepts and terms, and how retail traders can benefit from it.

What you need to know before placing your first spread bet, and how to make your experience effortless.

Are you sure spread betting is the right product for you? Check if CFDs are a better option for your needs.

Why Choose Spread Betting

How Does Spread Betting Work?

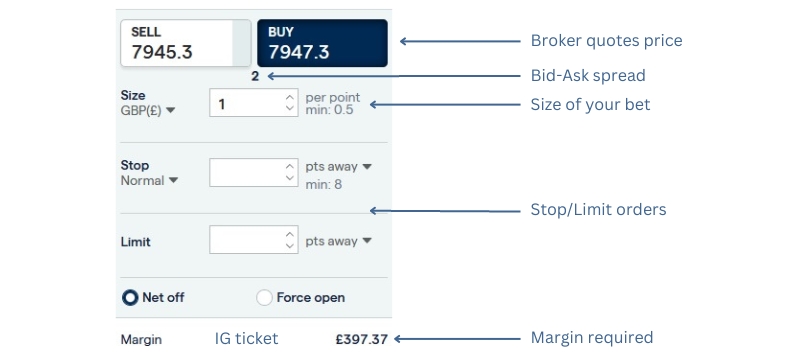

Spread betting brokers take ‘bets’, or more appropriately ‘positions’ in markets with dynamic pricing that responds as the market moves. The following illustration of spread betting pricing explains the basics of how spread betting transactions work.

We will use a FTSE100 spread betting example: The FTSE100 opens at 8,000. Amidst increasingly positive economic indicators and a number of key announcements pending, you conclude that the FTSE will rise on the day, and want to enter into the spread market for it. At the point where the FTSE100 sits at 8000, your broker may quote pricing at 7999-8001. What does this mean?

The prices given reflect the buy and sell prices of the market. As you are looking for a rise in the FTSE, you want to ‘buy’ the market at 8001. This essentially means you are betting that the market will rise beyond 8001, at which point you can start to earn multiples of your stake.

If you believed the market was likely to fall, you would ‘sell’ at 7999. This means you start earning multiples of your stake when the market falls below 7999. The difference in the middle (in this instance 8001 minus 7999 = 2 points) represents the broker’s commission (spread) on the trade. This works because the market has to rise an additional couple of points to yield a profit, thus the broker earns a commission on your successful trade before it starts to earn those elusive multiples for you.

Because pricing is dynamic in response to the underlying movements of the market, it pays to be decisive and get in early. If the FTSE100 in the above example started to rise to 8001, the market would be adjusted accordingly, perhaps to 8000-8002, making it harder for you to squeeze a profit from the market. The sooner you respond, the greater opportunity you will have for making money from the transaction.

Leverage is an integral part of spread betting, and it’s vital that traders understand how to use it correctly.

Even though spread betting might seem like an easy trading instrument, make sure you understand the risks.

Spread betting is a low-cost leveraged product allowing traders to benefit from its tax-free regime.

Spread Betting Examples

Simplified example (you can benefit from rising and falling markets):

Winning and losing examples:

Winning Trade

- The FTSE100 market is quoted as follows: 7999-8001

- You can either buy at 8001 (the offer price) or sell at 7999 (the bid price)

- You think the price will go higher than 8001 and you bet £1 per point

- Your expectation is right and you decide to sell at 8041

- You will then pocket £40 (40 * £1 per point)

Losing Trade

- The FTSE100 market is quoted as follows: 7999-8001

- You can either buy at 8001 (the offer price) or sell at 7999 (the bid price)

- You think the price will go lower than 7999 and you bet £2 per point

- Your expectation is wrong and you decide to exit at 8019

- You will then lose 7999-8019= -20 * £2 = loss of £40

What it looks like in real life:

* It’s recommended to always use stop-loss order especially when you’re just starting out – see full list of orders in spread betting.

Choosing the Right Account

Leverage and Margin

Leverage is the degree to which a trader can invest more than he has to cover financially. Often lent by the broker to fund larger transactions, it is inherent in the structure of spread betting, where traders get the advantage of multiplying returns from small gains in the relevant market.

Margin: The portion of a leveraged transaction the trader must be able to cover at any one time. Margin requirements are rolling and may therefore require traders to deposit more funds into their account (if there are not enough funds to cover the trade), otherwise open (and potentially profitable) positions will be liquidated.

Margin call: A demand from the broker for an addition deposit to cover liability, if the trader doesn’t cover the additional liability the broker will close the trade(s).

We used FTSE100 examples, FCA regulated brokers offer 1:20 leverage on indices, meaning that margin requirement is 5% (1 / 20 = 0.05 = 5%).

Key Features of Spread Betting

Key Advantages

Read more: Spread Betting Advantages and Benefits

Disadvantages

Read more: Spread Betting Disadvantages and Risks

Get Access to Over 1,000 Markets

Forex

Market

Spread Betting Forex

Shares

Market

Spread Betting Shares

Indices

Market

Spread Betting Indices

Commodities

Market

Spread Betting Commodities

Cryptocurrencies

More Markets

Market

More Spread Betting Markets

Managing Risks in Spread Betting

Spread betting is inherently risky, given the nature of the transaction. When a spread betting position moves up by 10 points, the return is 10 times the stake. When a position moves down by 10 points however, the loss is still 10 times the stake – that’s 10 times more than was invested up front. And with financial markets, there’s virtually no limit to the number of points a position can win or lose, which could land you in serious financial trouble.

Analyse Risks: Fortunately, there are ways in which you can counteract the risks of spread betting. Firstly, you need to be aware of the potential risks you’re facing, and you should always work out the numbers before making a particular trade. You might feel comfortable at £10 a point, until you realise that you could rack up a massive debt over a trading hour. Don’t get greedy, and remember that you can win and lose in equal measure.

Use Stop-Loss Orders: It is also possible to position stop-loss orders with the broker which prevent your liability from running away into problem territory. By setting stop-loss orders below the level of comfortable risk for each transaction, you can automatically cut out your losses before they become too significant.

Do your Homework: Another way in which you can personally limit the risks of your spread betting is through understanding the markets you are trading, and by keeping on top of developments affecting both your market and the assets you are trading within it. Bear in mind that you are trading alongside professionals who dedicate their entire working week (and then some) to reading about the markets – if you want to gain even a fraction of their success, it’s crucial that you too put in the legwork to help mitigate your potential losses through better, more consistent trades.

FAQs

Conclusion: Spread Betting Explained

Spread betting might seem easy in concept, it is a notoriously difficult art to master, and one which requires both an intimate understanding of how transactions work, the function of markets and the tools in the arsenal to help traders respond to different situations. While there is no substitute for raw experience, having the knowledge and understanding of your instrument of choice is the first positive step towards becoming a profitable trader with long term prospects.

Leverage has a key role to play, making transactions both significantly more profitable and significantly more risky, and the burden of leverage is not one to be accepted lightly. In spread betting, unlike other forms of trading, leverage is inevitable and unavoidable, insofar as it is a product of spread betting in its purest form. However, by taking care to ensure you understand the full implications of each transaction, and by identifying and managing the risks of each trade, it is possible to overcome the hurdles of leverage, and to apply it to your advantage.

Markets are the engine of spread betting and all financial trading and provide the basis for placing spread bets. The manner in which they behave and respond to certain changes provides the volatility necessary for spread betting to succeed, and by understanding their inner workings, traders can come a couple of steps closer to realising their potential. Similarly, orders remain the core tools of spread betting traders, implementing their instructions and delivering the flexibility necessary to guard against unwarranted risks and execute automatic trading decisions conditional on market behaviours. By understanding the way in which markets and orders interact, and the specifics of each order type, we can start to build up a picture of how the tools of the trade can be used to protect capital, maximise profits and lower the risk profile on this otherwise highly risky trading style.

Spread betting can be an exciting, fast-moving form of trading, and allows ordinary people from all walks of life to access the markets with very low barriers to entry. That said, the markets take no prisoners, and only by being proactive in your research, planning and strategy efforts can you give yourself the best shot at generating a consistent, aggregate profit from your trading activity.