Vault Markets (also called VaultMarkets) is an online broker targeting primarily African traders, offering forex, CFDs on commodities, indices, stocks, and cryptocurrencies. It is operated by 1st Fintech Capital (Pty) Ltd, which claims regulation under South Africa’s FSCA (Financial Sector Conduct Authority), and presents tools like MT4, MT5, multiple account types, and promotions to attract new users.

Only Trade with Regulated and Reputable Brokers

| Best Forex Brokers | Best CFD Brokers |

What Vault Markets Has to Offer

There is visible potential: low deposits, multiple asset classes, local payment options, and marketing that appeals to beginners. But when you dig deeper, several red flags emerge around regulatory clarity, corporate transparency, customer service consistency, and actual trader experiences. For those who trade small amounts or are new, Vault Markets may look good. But for anyone trading large volumes or expecting strong legal protections, the risks are significant.

Regulation & Security

Vault Markets claims to be regulated under FSCA in South Africa (FSP No. 51478). That gives some legal cover, but FSCA is not a Tier‑1 regulator; its oversight is good, but not at the level of FCA, ASIC, or other top regulators. There are doubts among users and reviewers about whether all the companies mentioned in its marketing are properly registered or have matching details in regulator registries (postal addresses, phone numbers, legal structure).

There is also criticism about whether some of Vault’s affiliate companies or partners (in Namibia, Cyprus) are actually licensed. If they are not, there may be parts of the service or payment processing that lie outside regulated oversight. Encryption and account security are mostly standard, but there is limited information on whether there is negative balance protection, compensation schemes, or strong, enforceable dispute resolution.

In sum, Vault Markets offers a regulatory base that is above completely off‑shore brokers without oversight, but it is not strong enough to fully reassure traders who care deeply about legal security and long‑term institution stability.

Trading Platforms

Vault Markets provides access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely used, with lots of support in indicators, automated trading (EAs), custom charting, mobile and desktop apps. That is a plus.

There is no proprietary trading platform that stands out. The website and user reports mention that some claims about platform features may be misleading (e.g. about mobile apps, about functionality). The execution speed may vary depending on region and network. For those who want guaranteed premium infrastructure (low latency, stable servers under heavy load) the lack of independent benchmarks is a concern.

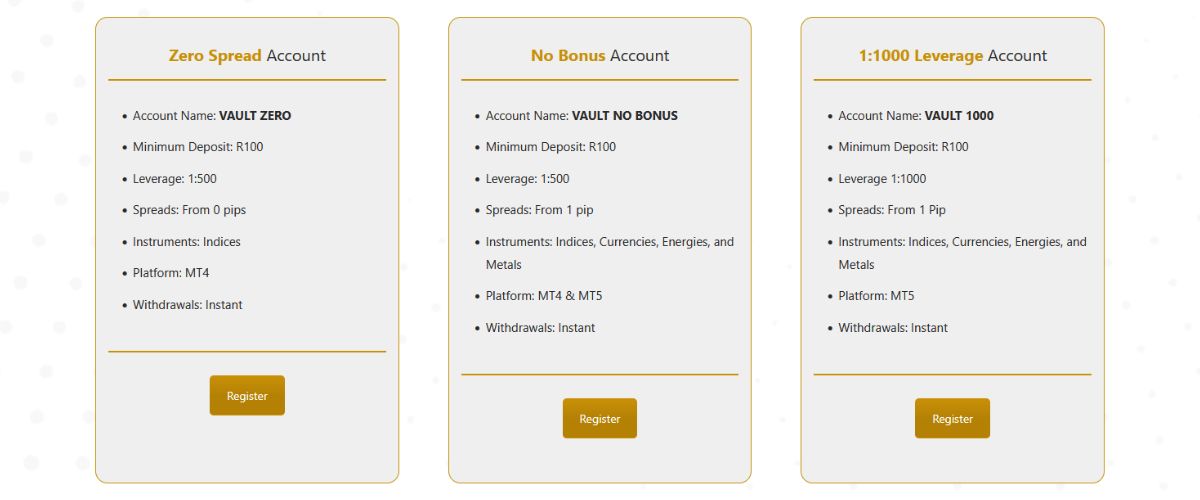

Account Types

Vault Markets mainly provides four account types, each aimed at a particular trading profile. The differences are primarily in spreads, commission structure, leverage, and bonus availability.

Some of the Account Types on Vault Markets

Here’s how they compare:

Each account type is available in the MT4 and MT5 environments. Minimum deposits are kept low across all tiers, and users can choose based on trading strategy, risk tolerance, and whether or not they wish to take part in promotions.

Trading Instruments

Vault Markets advertises a broad selection of instruments: forex pairs (majors and minors), indices, stocks, commodities (metals, energy), cryptocurrency CFD pairs. They claim access to dozens of currency pairs (though some users say the number is less or that some advertised pairs aren’t actually available).

The crypto CFD offering is smaller, and sometimes subject to added fees or restrictions. The broker also offers equity CFDs and indices relevant to African markets, which is a plus for regional traders. However, traders who want deeper options (exotics, small‑cap stocks, more niche markets like bonds or futures) may find Vault’s instrument set limited in comparison to large global brokers.

Vault Markets Pros and Cons

Pros

Cons

Vault Markets Reviews from the Web

Many users praise Vault Markets for being more approachable than many brokers in Africa: they value local payment methods, helpful onboarding, responsive support in many cases, and a sense that the broker is trying to serve local traders well. Positive feedback especially around deposit/withdrawal being smoother than many off‑shore brokers, and the platforms being easy to use.

But there is a persistent undercurrent of dissatisfaction. Common complaints: account verification delays, withdrawal hold‑ups, difficulty understanding bonus terms, promotional offers that clash with reality, inconsistency in spreads, and sometimes a feeling that customer support is much slower or less helpful when issues relate to funds or profits. A number of users warn that what is advertised is not always fully delivered.

Vault Markets FAQs

Final Thoughts on Vault Markets

Vault Markets positions itself as a practical entry point for traders in Africa, offering low deposit requirements, access to popular platforms like MT4 and MT5, and flexible account types designed to match a wide range of trading styles. For those just beginning their trading journey or working with smaller amounts of capital, the platform appears approachable and well-suited for initial experimentation.

However, the limitations are equally clear. The absence of regulation from Tier-1 financial authorities, strict bonus account restrictions, and the lack of an investor compensation scheme leave traders with reduced protection. While the platform may satisfy casual or small-scale traders, those managing larger funds or looking for long-term dependability should proceed with caution.

In short, Vault Markets is serviceable for basic trading needs in specific regions, but it does not currently offer the kind of robust, globally trusted structure that more experienced or risk-averse traders might require. As with any broker, reading the terms carefully and starting with smaller trades is the safest way to assess its suitability firsthand.