StarTrader is one of those brokers that quietly ticks more boxes than you might expect. Founded in 2011 and now licensed in multiple regions, it has steadily built a global presence while offering a product set that caters to both beginners and experienced traders. StarTrader looks like it’s trying to strike the right balance between accessibility and performance.

Only Trade with Regulated and Reputable Brokers

| Compare Regulated Forex Brokers | Compare Regulated CFD Brokers |

What StarTrader Has to Offer

At first glance, StarTrader doesn’t rely on flashy marketing or exaggerated claims. Instead, it delivers a clean interface, well-supported platforms like MT4 and MT5, and an account structure that’s flexible enough for different trading styles. The broker offers access to a wide variety of instruments, from forex and indices to metals and stocks, all delivered through familiar, stable platforms.

While not quite a household name, StarTrader is clearly positioning itself as a serious option for those who want decent pricing, a strong feature set, and reliable execution – all backed by regulatory oversight in several regions. It’s not perfect, but there’s enough here to take a closer look.

Regulation and Security

StarTrader’s regulatory profile is one of its stronger points – especially for traders who want peace of mind without being locked into restrictive jurisdictions. The broker is authorised by several regulators, including:

- The Australian Securities and Investments Commission (ASIC), known for enforcing high standards of conduct and capital requirements.

- South Africa’s Financial Sector Conduct Authority (FSCA), which brings regional credibility and a growing reputation among retail traders.

- Capital Markets Authority (CMA) in Kenya, adding localised oversight in Africa.

- Seychelles Financial Services Authority (FSA) – a more flexible offshore regulator, but still a step above brokers operating without any oversight at all.

- SVGFSA (Saint Vincent and the Grenadines) – often used for registration but provides no real regulatory supervision.

So while it’s not regulated in the EU or UK, StarTrader still holds several active licenses and doesn’t operate as a typical offshore-only broker. Client fund protection varies by region, and there’s no investor compensation scheme under these regulators, but the multi-jurisdiction structure does lend the broker more credibility than most in its category.

Trading Platforms

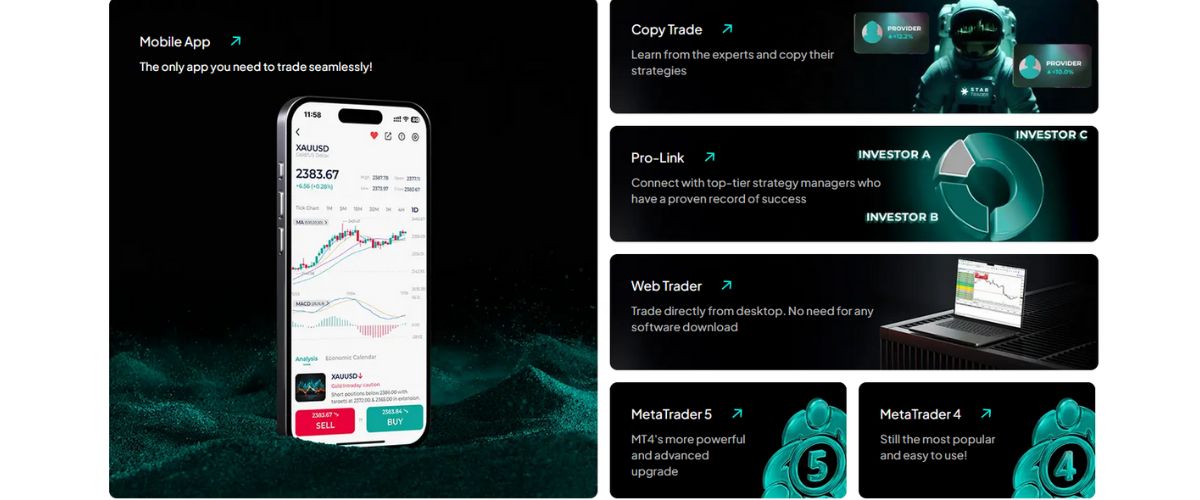

StarTrader offers a clean, reliable platform lineup that caters to most trading styles without overcomplicating things. Traders have access to three core platforms, each with its strengths:

Execution across platforms is smooth, with no major issues reported. The mobile apps for MT4 and MT5 are also available, giving traders full control from anywhere.

In terms of trading tools, StarTrader offers VPS hosting for algorithmic traders who rely on Expert Advisors and need uninterrupted uptime. There’s also access to Trading Central, which delivers technical analysis, trade ideas, and market commentary – useful for those who appreciate a second opinion before pulling the trigger.

It’s a practical setup. No gimmicks, just platforms and tools that actually help you trade.

Account Types

StarTrader offers three core account types, each designed to meet the needs of different trading styles and levels of experience. The structure is clean and easy to understand, with a low entry point that makes it accessible to most traders.

In addition to these, StarTrader also provides a swap-free (Islamic) account option for clients who require interest-free trading in line with religious principles. This can be requested at the time of account opening or added later.

Markets and Instruments

StarTrader delivers a focused yet diverse portfolio of tradable assets, offering everything most retail and even experienced traders might look for. Rather than padding its offering with obscure markets, it covers the essentials, and does so with precision.

In total, StarTrader offers access to hundreds of instruments across all categories. It’s not the most extensive product list on the market, but it’s certainly more than enough for serious traders – and without the clutter. The broker clearly focuses on the most traded markets, which helps keep execution clean and spreads tight where it counts.

Fees and Spreads

StarTrader keeps its pricing competitive across the board. On the Standard Account, spreads start from around 1.3 pips, with no commissions, making it a simple option for beginners. The ECN Account and Prime ECN Account offer raw spreads from 0.0 pips, with commissions of $6 and $3 per round-turn, ideal for active traders seeking tighter pricing.

Leverage goes up to 1:500, depending on the asset, with forex offering the highest levels. While high leverage can boost exposure, it also increases risk, so a disciplined approach is essential. Negative balance protection is included.

There are no deposit or withdrawal fees on StarTrader’s side, which is a welcome plus. Swap rates and overnight charges are transparently listed in the trading platform.

Customer Support and Education

Customer service is available via live chat, email, and phone. Support is said to be 24/5, but response times vary. Some traders have reported fast help, while others struggled to get answers to more technical queries.

As for educational material, StarTrader’s content is thin. You’ll find a basic glossary, a few articles about market movements, and a short FAQ section, but not much else. There are no structured courses, strategy videos, or interactive webinars, which makes it less appealing for beginners who need more hand-holding.

StarTrader Pros and Cons

Pros

Cons

StarTrader Reviews from the Web

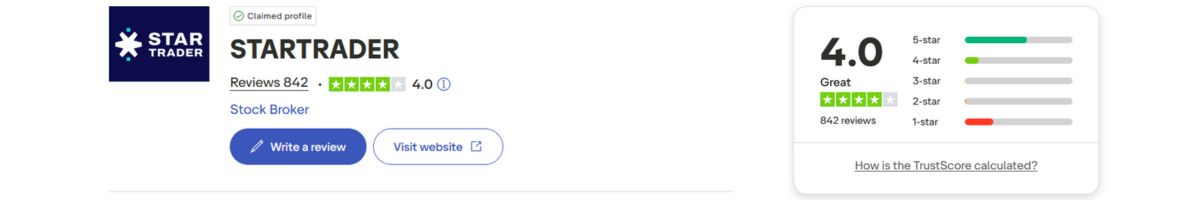

User feedback across online forums and platforms like TrustPilot is mixed. Some traders appreciate the simplicity of signing up and the availability of MetaTrader platforms. A few have noted tight spreads and quick funding times.

However, others have raised concerns about withdrawal delays, lack of transparency on fees, and poor customer support. A common thread is that while things start smoothly, problems arise when users try to withdraw larger profits or close accounts.

As with many brokers, reviews appear polarised, and this inconsistency is something traders should keep in mind.

StarTrader FAQs

StarTrader: What You Need to Know

StarTrader positions itself as a serious contender in the online trading space, backed by multiple regulatory licenses and a clean, professional setup. Its support for MT4, MT5, and WebTrader offers enough flexibility for most traders, and multiple deposit options make it easy to test the waters without over-committing.

Spreads are competitive, execution is smooth, and their tiered account structure offers decent variety depending on how hands-on or cost-sensitive you want to be. On top of that, ongoing promotions and a transparent pricing model add to the broker’s appeal.

That said, StarTrader is not perfect. It lacks regulation in Europe, doesn’t support crypto trading, and doesn’t offer quite the same breadth of instruments as some of the larger, more established brokers. The educational section is also underwhelming if you’re just starting out and looking for structured learning.

Overall, StarTrader is a good choice for traders who already know what they want, especially if regulation outside the EU isn’t a deal-breaker. For beginners or those looking for crypto and a broader asset range, there might be better alternatives. Still, as a no-fuss, cost-effective platform, StarTrader delivers where it matters.