FundingPips is a proprietary trading firm offering access to capital through a range of structured challenges and instant funding options. The firm appeals primarily to experienced traders seeking to scale without risking personal funds, with a particular emphasis on flexibility, competitive profit splits, and low-cost entry points.

Through a selection of one-step, two-step, and direct funding models, FundingPips positions itself as a practical route for traders who can demonstrate consistent performance under defined risk conditions. While the firm offers strong features across account options and payout flexibility, questions remain about platform limitations and rule transparency.

How Funding Pips Works and Operates

FundingPips gives traders access to the firm’s capital through a set of structured evaluations, each designed to test profitability and risk control. These assessments range from one-step and two-step challenges to an instant funding model, offering flexibility across different trading profiles. Traders who meet the performance targets without breaching the firm’s risk limits are offered funded accounts with profit splits that increase based on consistency and account type.

Each challenge enforces clear rules around drawdown, profit targets, and minimum trading activity. Depending on the model selected, traders may face different cost structures, timelines, and eligibility criteria. The firm allows for rapid onboarding, and while it promotes high payout potential, traders must navigate strict limits and recurring charges that could affect long-term profitability.

Available Platforms and Markets on FundingPips

FundingPips supports a range of trading platforms to accommodate different trader preferences and technical setups. These include MetaTrader 5 (MT5), cTrader, Match-Trader, and TradeLocker. All platforms are accessible via desktop, web browser, and mobile apps, allowing for flexible access across devices.

MetaTrader 5 remains the industry standard for many discretionary and algorithmic traders, offering advanced charting tools and EA compatibility. cTrader appeals to those who prefer a more modern interface and native depth-of-market features. Match-Trader and TradeLocker provide lightweight solutions geared toward ease of use.

FundingPips gives access to over 100 tradable instruments across five asset classes:

- Forex: Major, minor, and some exotic currency pairs, with leverage up to 1:100.

- Indices: Popular indices such as US30, NAS100, SPX500, GER40, and UK100.

- Commodities: Energy assets including crude oil and natural gas.

- Metals: Precious metals such as gold and silver.

- Cryptocurrencies: Leading crypto pairs like BTC/USD and ETH/USD, offered with lower leverage caps due to volatility.

Market access may vary slightly depending on the platform. Automated strategies are permitted during evaluation but restricted on funded accounts to maintain trader engagement and risk oversight.

FundingPips Plans, Fees, and Payout Structure

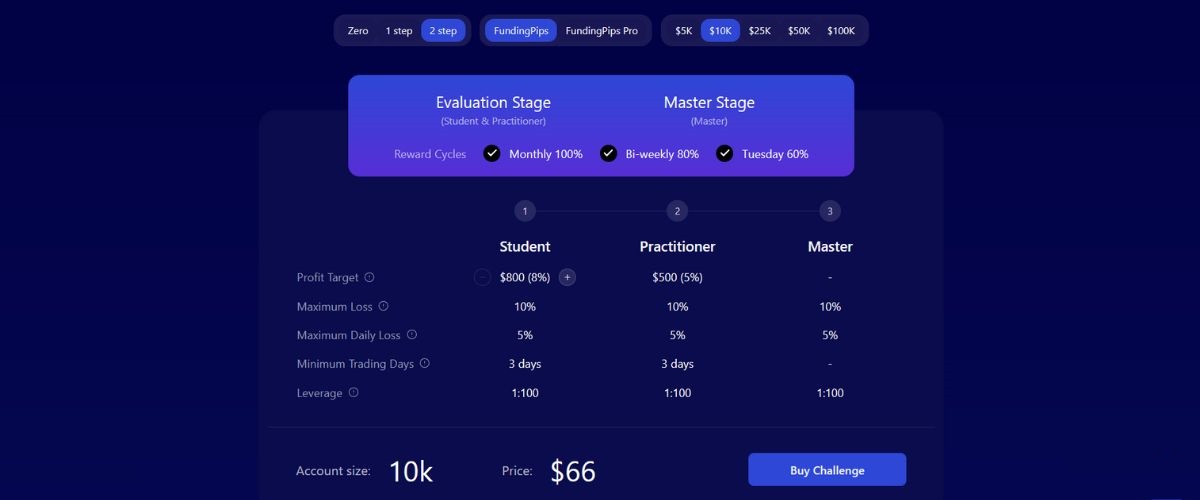

| Account Size | Evaluation Fee (One-time) | Profit Target | Max Daily Loss | Max Drawdown | Profit Split |

|---|---|---|---|---|---|

| $10,000 | $66 | 8% | 5% | 10% | From 80% |

| $25,000 | $156 | 8% | 5% | 10% | From 80% |

| $50,000 | $289 | 8% | 5% | 10% | From 80% |

| $100,000 | $529 | 8% | 5% | 10% | From 80% |

FundingPips offers several evaluation paths. Each comes with specific targets, drawdown limits, and rules. The main account types include:

Note: The more phases a challenge includes, the lower the cost and the more lenient the rules. Instant funding offers speed, but it is priced at a premium and leaves little margin for error.

Payout Terms and Profit Split Options

Profit splits begin at 80% and can increase to 100% for top-performing traders. The Zero model and Hot Seat tier offer the highest split percentages, but only after strict conditions are met.

Payouts are available weekly, bi-weekly, monthly, or on demand, depending on account type. All withdrawals are subject to a fixed processing fee. Traders can begin receiving profits once they reach the payout threshold and meet all compliance criteria, including adherence to drawdown limits.

Reset Fees and Refund Eligibility

If a challenge is failed, whether due to rule breaches or performance shortfalls, traders must purchase a new evaluation. There are no free retries or automatic resets.

Some plans offer a refund of the evaluation fee after the first successful withdrawal from a funded account. However, this is not universal and only applies to initial challenge purchases—not resets or upgrades.

Scaling and Trader Progression Paths

FundingPips offers scaling opportunities for traders who demonstrate consistent results and risk control. Eligible traders may receive larger accounts, better payout terms, or placement in high-tier programs like Hot Seat. Advancement depends on overall performance and adherence to the firm’s trading guidelines over time.

This progression structure is suited to long-term traders who value a clear growth path based on merit rather than time served.

FundingPips Pros and Cons

Pros

Cons

FundingPips FAQs

What You Need to Know About FundingPips

FundingPips presents a competitive funding model for traders with a proven edge and a disciplined approach to risk. With multiple challenge formats, up to 100% profit split potential, and access to a wide range of platforms and markets, the firm offers a clear route to scaling without personal capital exposure.

That said, FundingPips operates within a rule-driven structure. There are no second chances for drawdown breaches, withdrawal fees apply, and the firm enforces limits on automation and platform usage. It’s best suited to traders who value structure, understand the cost-risk trade-off, and are prepared to adapt to evolving terms.

For committed traders who can perform under constraints, FundingPips offers a legitimate path to capital access and performance-based payouts, with enough flexibility to accommodate both intraday and swing strategies across multiple asset classes.