Unregulated Broker, Be Cautious When Trading with FreshForex

FreshForex has been around since 2004, advertising itself as a low-barrier entry point into the forex and CFD markets. With high leverage, minimal deposits, and familiar MetaTrader platforms, it might appear attractive — especially to beginners. But beyond the promotional banners and generous-sounding bonuses, the picture isn’t quite so encouraging.

The broker operates under loose offshore regulation, and user reviews across various platforms point to issues with withdrawals, unexplained account changes, and lacklustre support. These aren’t isolated complaints either — they show up frequently enough to raise serious questions. So while FreshForex might offer affordability and flexibility, there’s a growing list of reasons to be cautious.

In this review, we’ll explore what the broker claims to offer, what it actually delivers, and whether any of it is worth your time — or your money.

Only Trade with Regulated and Reputable Brokers

| List of Forex Brokers | List of CFD Brokers |

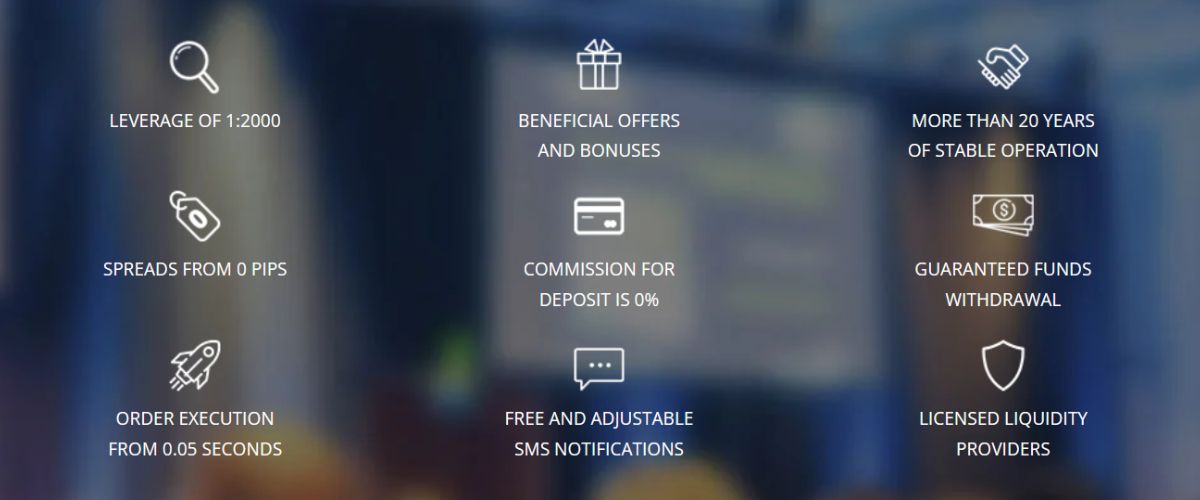

What FreshForex Has to Offer

Regulation and Safety

FreshForex is operated by Riston Capital Ltd, based in Saint Vincent and the Grenadines, a jurisdiction known more for its tax haven status than strong financial oversight. This means the broker isn’t subject to meaningful external audits or strict investor protection rules.

While FreshForex states that it maintains segregated client funds, there’s no independent enforcement to verify this. In the absence of top-tier regulation, traders carry significantly more risk, especially when disputes or fund recovery issues arise.

Trading Platforms

FreshForex supports both major MetaTrader platforms:

Both platforms are available on desktop, browser, and mobile apps, a strong point in FreshForex’s favour. However, platform reliability depends on the broker’s internal infrastructure, which some traders have criticised during high-volatility periods.

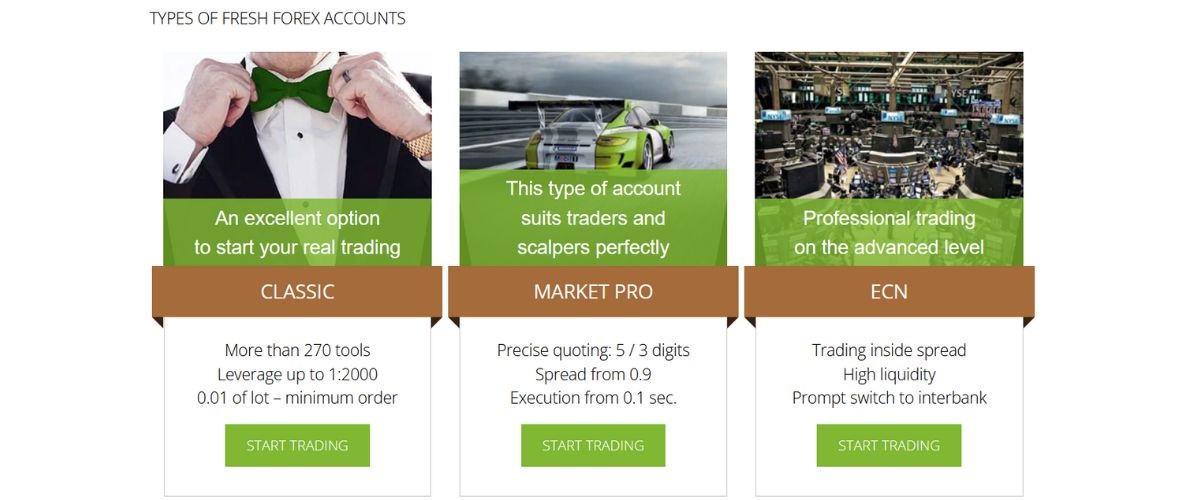

Account Types

FreshForex offers three core account types, plus a swap-free version for traders observing Islamic finance rules:

Account structure is fine on paper, but user reviews mention inconsistencies in how spreads and execution are handled, another potential red flag.

Markets and Instruments

FreshForex provides access to over 270 instruments, spread across:

The selection is enough for most retail traders, but those looking for a more expansive portfolio may find it restrictive.

Spreads and Fees

FreshForex’s pricing depends heavily on the account you choose:

There are no deposit fees, but withdrawal charges may apply, depending on the method, you might face fees between 0.1% and 3.5%.

Bonuses and Promotions

FreshForex leans heavily on its bonus structure to attract new traders:

It’s classic marketing: bonuses that sound generous but require careful reading of the fine print. Traders are advised to tread carefully and avoid relying on promotional offers to boost account value.

Trading Signals and Tools

FreshForex offers free trading signals for clients, a useful feature if used wisely. These signals include entry, stop-loss, and take-profit levels, updated throughout the day. However, there’s no transparency around their win rate or methodology.

Other tools include:

- An economic calendar

- Technical market updates

- Occasional webinars

It’s not a bad toolkit for beginners, but don’t expect institutional-level analytics or innovation here.

FreshForex Pros and Cons

Pros

Cons

FreshForex’s Reviews from the Web

Freshforex.com removed my 5000$ profit on PFA: ” I closed the trade after 5 minutes of news release.Later today they removed those profit and delete the order history. Before opened the account, they told me “News trading and scalping trading is allowed”. But now removed those profit.Please help me to get my profit amount.”

FreshForex deceives people on PFA: “FreshForex company deceives people. When people start to write that they have lost money, scammers create a new site with a new name. All companies have the same work scheme, only different names.”

Freshforex is a scam on BabyPips: “Found another forex scam site and scam review’s in google.FreshForex is scam i see it many website’s. They arr not give any goods support for all customers.”

Final Thoughts: High Risk, Low Commitment; Is It Worth It?

FreshForex might look like a convenient shortcut into trading: low deposits, high leverage, and frequent bonuses are all there to lure you in. And for some, it may offer exactly what they’re looking for: fast market access and flexible trading terms.

But the flip side is hard to ignore. Loose offshore regulation, consistently poor user feedback, high spreads on entry-level accounts, and unclear fund protection all raise red flags. You’re essentially trading on trust, and based on what many traders report, that trust has been tested more than once.

If you’re going to use FreshForex, go in with eyes wide open, keep your risk exposure in check, and avoid relying too heavily on the bonus bait. For most traders, especially those just starting out, safer options exist — ones that don’t come with so many question marks.