A proprietary trading firm operating out of the UK, Funded Trading Plus is ideal for traders seeking diversity. This platform was established in 2022 and has quickly become a favourite of many experts, as evidenced by its 4.6/5 Trustpilot rating. There are trading models and account types for beginners and experts, allowing everyone to enjoy this platform. In this review, we’ll take a look at the rules, flexibility, profit shares, fees, and features to help you determine if Funded Trading Plus is the right prop firm for you.

| Features | Details |

|---|---|

| Fees | One-time challenge fees |

| Leverage | Up to 30:1 |

| Profit Split | 80/20 split for starters (can be up to 100%) |

| Standout Feature | No time limits on challenges Overnight holding is allowed Weekend holding is allowed (on most models) All trading strategies are welcome |

How Funded Trading Plus Works

There are three main paths to getting a funded account on Funded Trading Plus, and you can choose whichever works best for you.

Platform Philosophy

There are minimum trading days required for this platform, unlike most others. Funded Trading Plus is ideal for traders seeking a quantified scaling structure and has room for multiple trading strategies.

Account Types

You can choose from one of three possible account types:

One-Phase Evaluation (Experienced Trader Program)

- 10% profit target

- 3% daily drawdown

- 6% overall drawdown

Two-Phase Evaluations

- 10% profit target in phase 1

- 5% in phase 2

- 5% daily drawdown

- 10% overall drawdown

Instant Funding (Master Trader Program)

- No evaluation phase

- 5% total drawdown, no daily limits

Platforms and Markets

Trading Platforms: Traders on Funded Trading Plus have access to several trading platforms. MetaTrader 5, cTrader, MatchTrader, and DXTrade are all available. Match-Trader and DXTrade are web and mobile-friendly, while cTrader attracts a $25 fee.

Markets Available: Funded Trading Plus provides a wide range of assets to trade, covering all major classes:

| Markets | Details |

|---|---|

| Forex | 60+ currency pairs (EUR/USD, GBP/USD, USD/JPY, etc.) |

| Indices | S&P 500, NASDAQ, Dow Jones, DAX, FTSE100, and others |

| Commodities | Crude oil (US Oil, UK Brent), Precious Metals |

| Cryptocurrency | BTC, ETH, DOGE, ADA, and more |

Plans, Pricing, and Payout Structure

Here is an in-depth look at the key parameters, fees, and account sizes in standard programs, using the advanced model as a reference:

| Account Size | Evaluation Fee (One-time) | Profit Target | Max Daily Loss | Max Drawdown | Profit Split |

|---|---|---|---|---|---|

| $12,500 (1-Step) | $119 | 10% | 4% | 6% | From 80/20 |

| $25,000 (2-Step) | $199 (Adv.) $247 (Prem.) | 10% (8% Prem.) | 5% (4% Prem.) | 10% (8% Prem.) | From 80/20 |

| $50,000 (2-Step) | $349 (Adv.) $397 (Prem.) | 10% (8% Prem.) | 5% (4% Prem.) | 10% (8% Prem.) | From 80/20 |

| $100,000 (2-Step) | $499 (Adv.) $547 (Prem.) | 10% (8% Prem.) | 5% (4% Prem.) | 10% (8% Prem.) | From 80/20 |

| $200,000 (2-Step) | $949 (Adv.) $1,097 (Prem.) | 10% (8% Prem.) | 5% (4% Prem.) | 10% (8% Prem.) | From 80/20 |

Funded Trading Plus Evaluations

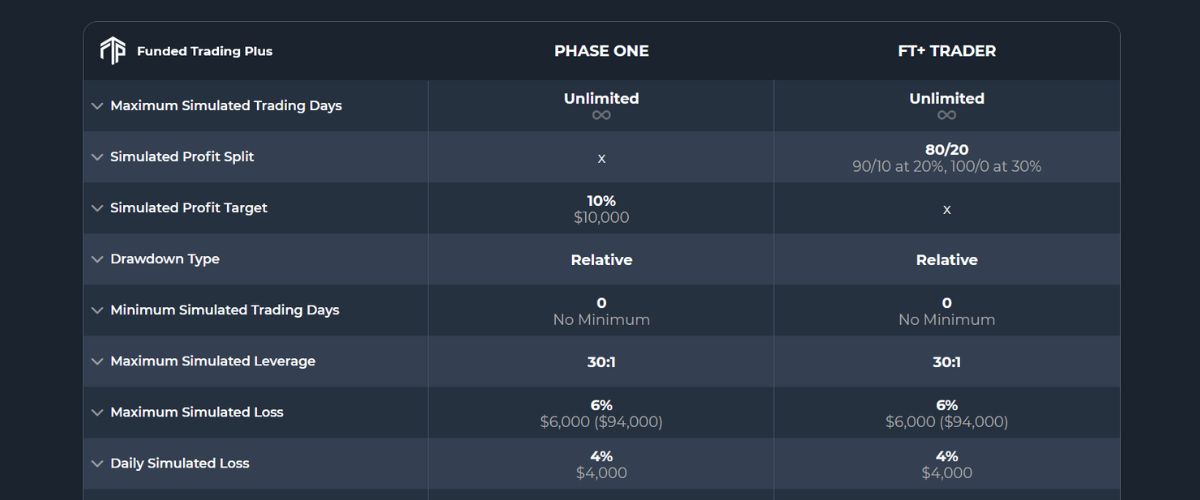

One Stage Evaluation for $100K Account

Evaluation Models and Account Types

Funded Trading Plus provides flexibility in how you get funded. Here’s a closer look at each account type:

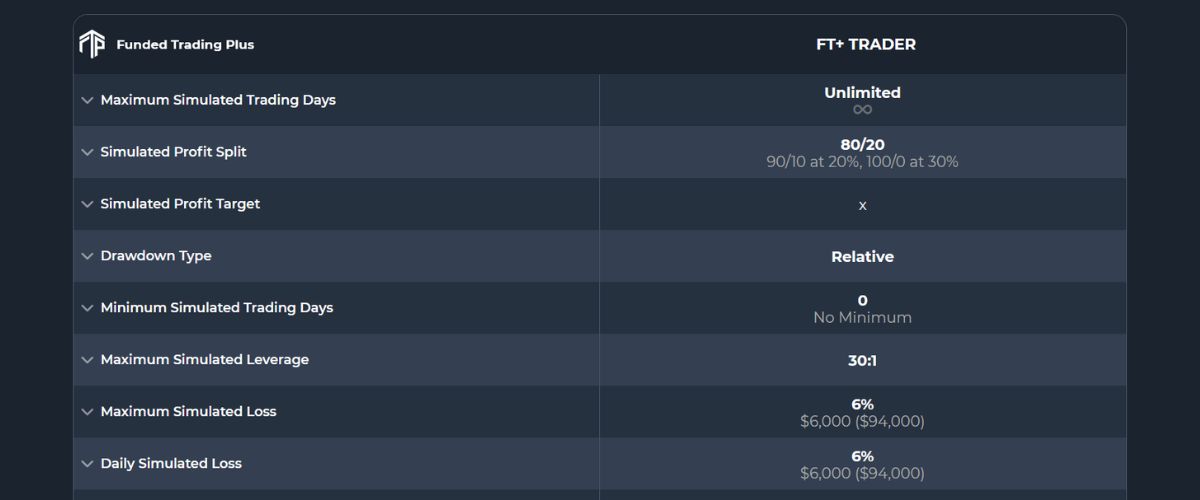

Instant Funding for $100K Account

Suggested Pre‑Entry Checklist for Expert Traders

Experts should follow this process before proceeding with Funded Trading Plus:

Profit Splits and Withdrawals

Funded Trading Plus offers very competitive profit-sharing and flexible withdrawal terms:

Scaling and Trader Progression

Funded Trading Plus offers a favourable scaling plan, allowing traders to grow their accounts up to $2,500,000:

Funded Trading Plus Pros and Cons

Pros

Cons

Funded Trading Plus FAQs

Is Funded Trading Plus for You?

If you’re a disciplined trader with solid strategies and risk management, then Funded Trading Plus is the ideal platform. Accounts are highly scalable, there are no time constraints on the challenges, the profit shares are impressive and it supports algorithm trading.

The only thing that can stop you on this platform is breaking the rules, so as long as you follow the rules, you’ll have no problems. You can comfortably evaluate your trading strategies and leverage needs before you need to fund your account.

A trader-friendly prop firm, Funded Trading Plus, has established itself as a platform that promotes long-term success. With no time limits, high potential payouts, and various account types, it’s easy to see why many traders love this platform.