Instant funded prop firms are increasingly popular among retail traders, offering immediate access to live capital without passing evaluation stages. The appeal lies in skipping challenges and trading larger accounts right away, but this convenience comes with higher costs, stricter rules, and less flexibility. Understanding how instant funding works, along with its benefits and risks, is essential before committing.

Key Points: Instant Funding and Prop Firms

What Is Instant Funding?

Instant funding refers to the ability to trade a funded account without first completing a challenge or verification stage. Standard prop firm models require traders to prove their consistency and risk management across one or more evaluation phases. In contrast, instant funded prop firms provide immediate access to live capital once the entry fee is paid.

The defining characteristics of instant funding accounts include:

- No evaluation or profit target stages before funding.

- Higher entry fees compared to evaluation challenges.

- Strict daily and overall drawdown rules to protect firm capital.

- Profit splits that often match or exceed traditional models, usually ranging from 80% to 100%.

Instant funding is marketed as the fastest way to trade firm capital, but it is important to note that the absence of an evaluation does not mean the absence of rules. Traders must still operate within the firm’s risk framework at all times.

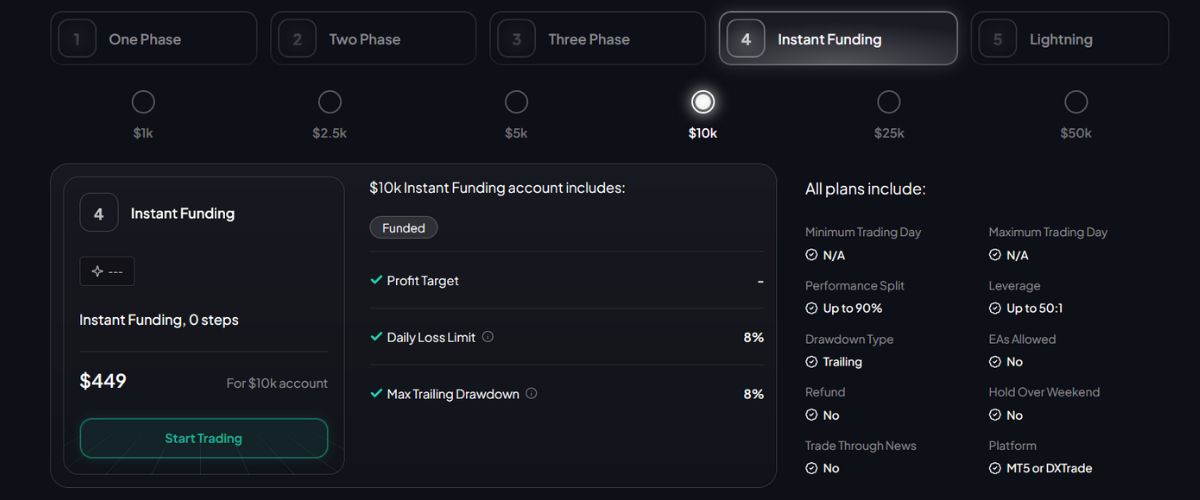

FXIFY Instant Funding for $10K Account

How Instant Funding Works

Instant funding allows traders to skip evaluation challenges and begin trading live capital immediately. By paying a one-time fee, they secure an account that can range from $5,000 to over $200,000, depending on the firm and funding tier selected. While this removes the uncertainty of passing multi-stage tests, it also means the upfront costs are considerably higher.

Once funded, the account is governed by strict rules. The most important are the drawdown limits, which leave little margin for error. Daily losses are usually capped at 3 to 5 percent, while overall account drawdown is set between 6 and 10 percent. Breaching these thresholds typically results in immediate termination, with no chance to reset or continue. This creates a demanding environment where discipline and accuracy in risk management are essential.

The defining features of instant funded prop firms include:

In practice, instant funding replaces the uncertainty of an evaluation with the certainty of cost and the immediacy of risk. There is no buffer period where traders can adjust to firm rules before real capital is involved. Every decision carries weight from the start, which is why this model tends to favour disciplined traders with proven strategies.

Why Traders Choose Instant Funding

Why Instant Funding Can Be Risky

Pros and Cons of Instant Funding

Pros

Cons

Frequently Asked Questions

Is Instant Funding the Right Path for You?

Instant funded prop firms provide one of the fastest routes to trading firm capital. By removing evaluation stages, they offer immediate access, generous profit splits, and flexible payouts. For disciplined traders with proven strategies, this model can accelerate growth and create consistent cash-flow opportunities.

Yet speed and certainty come at a price. Entry fees are higher, drawdown limits are stricter, and there is little tolerance for mistakes. Success depends on precise risk management, psychological resilience, and choosing a reputable provider with transparent policies.

For those ready to meet these demands, instant funding can serve as a powerful shortcut to professional-level trading. For others, especially those still refining their skills, it may prove costly and unforgiving. The decision ultimately rests on whether your trading discipline is strong enough to thrive in a high-pressure, rule-driven environment.