PU Prime, established in 2015, is a trading platform that offers a wide range of financial instruments, from forex and cryptocurrencies to indices and commodities. Headquartered in Seychelles, the broker is regulated by the Seychelles Financial Services Authority (FSA) and has more recently come under the oversight of additional regulators such as ASIC. While PU Prime does not currently hold licenses from European regulators such as the FCA, the broker is supervised by ASIC, a top-tier authority known for its strong standards in client protection. This regulatory gap becomes even more concerning when you note the recent alerts on TrustPilot, which mention that PU Prime has received “regulatory attention.” While it doesn’t necessarily mean outright wrongdoing, it’s an indication that potential traders should be cautious.

Only Trade with Regulated and Reputable Brokers

| Best Forex Brokers | Top CFD Brokers |

What defines PU Prime in a crowded market is its broad service offering, promising competitive spreads, multiple account types, and various trading platforms. Yet, beneath these features, there are enough inconsistencies and customer concerns to warrant a closer inspection.

What Makes PU Prime Different?

PU Prime attempts to differentiate itself through its wide variety of trading instruments, promising up to 200+ assets across forex, commodities, cryptocurrencies, and indices. The broker offers access to popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both well-known for their comprehensive features and customization options. These platforms are staples in the industry, and while having them is a plus, it doesn’t necessarily set PU Prime apart from many other brokers who offer the same.

The broker also claims to have competitive spreads starting from 0.0 pips on certain account types, suggesting it’s aiming for a professional trading clientele. However, digging deeper into their fee structures reveals that those zero spreads often come with added commissions, which aren’t always clearly disclosed upfront. Transparency seems to be an area where PU Prime struggles, making it harder for traders to assess the true cost of trading with them.

PU Prime highlights its multilingual customer support, which operates 24/5, and boasts several awards for its services. Still, many of these awards come from relatively obscure organizations, which casts doubt on their legitimacy. It’s worth noting that many brokers pay for such recognitions, and they don’t necessarily reflect genuine quality or customer satisfaction.

What PU Prime Has to Offer

When evaluating PU Prime’s offerings, the picture gets mixed. The broker provides access to MT4 and MT5 trading platforms, which are industry standards due to their robust charting tools, indicators, and algorithmic trading capabilities. This inclusion is undoubtedly a positive but hardly unique, as most reputable brokers offer these platforms. Additionally, PU Prime offers its own WebTrader platform, although it’s less feature-rich than MT4 or MT5 and can feel clunky at times, especially during high forex market volatility.

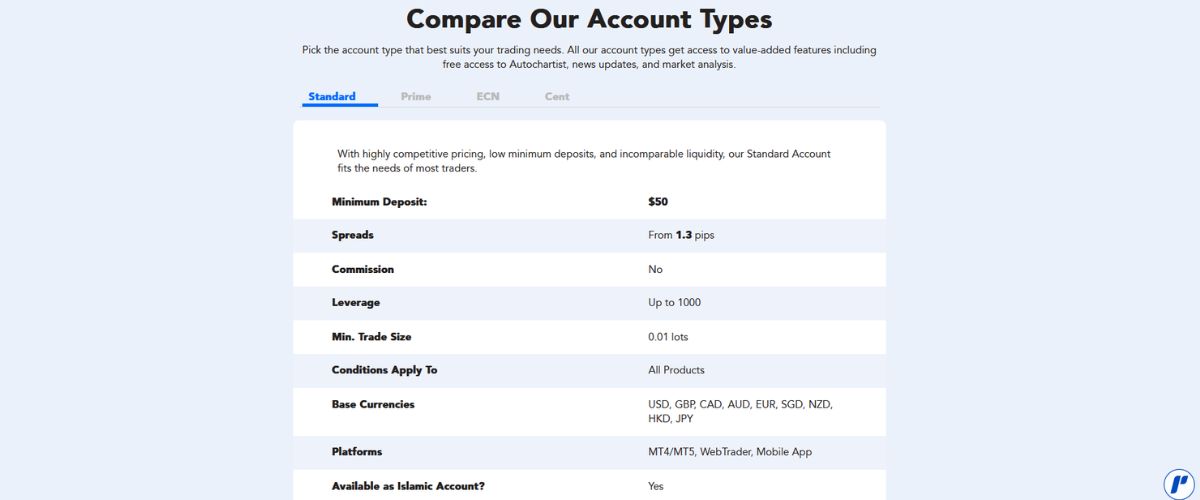

Account Types: PU Prime offers four primary account types – Standard, Prime, ECN, and Cent Accounts. While the variety is commendable, there’s a notable discrepancy in the spreads and fees across these accounts. The Standard account, for instance, features wider spreads, making it less attractive to serious traders, while the Prime account offers tighter spreads but charges commissions that aren’t as transparent as they should be. The Cent Account, marketed towards beginners, offers conditions that are less favourable than many competitors’ forex demo accounts.

Range of Instruments: PU Prime does well in providing a wide range of CFD trading instruments, covering forex pairs, commodities, indices, stocks, and cryptocurrencies. However, while the variety might seem appealing, the execution can be inconsistent, with frequent reports of slippage and delayed order executions. For a broker claiming to cater to experienced traders, this is a glaring flaw that could affect profitability, especially for those engaged in high-frequency or scalping strategies.

Fees and Spreads: One of the areas where PU Prime seems to fall short is its fee structure. While they advertise competitive spreads, users frequently report that the actual trading costs are much higher due to hidden commissions and wider-than-advertised spreads during volatile market conditions. There’s also a lack of transparency around swap rates, which can significantly impact overnight positions.

Deposit & Withdrawal Options: PU Prime offers various deposit and withdrawal options, including bank transfers, credit cards, and e-wallets like Skrill and Neteller. However, several users have reported delays in processing withdrawals, with some complaints indicating it can take up to two weeks to access funds. This is far from ideal and raises questions about liquidity and the broker’s financial stability.

Customer Support & Educational Resources: PU Prime’s 24/5 multilingual customer support is responsive enough but not exceptional. It’s not uncommon to encounter support agents who seem to have limited knowledge about the broker’s offerings, which can be frustrating when trying to resolve complex issues. Their educational resources, while present, are quite basic and lack the depth and quality seen with more established brokers.

PU Prime Pros and Cons

Pros

Cons

Reviews from Forums and External Sources

TrustPilot are aware that broker PU Prime has received regulatory attention.

When browsing forums like Forex Peace Army and TrustPilot, it’s evident that PU Prime’s reputation is mixed. On TrustPilot, PU Prime holds an average rating, but it’s essential to approach these numbers cautiously, as there are frequent reports of “fake” positive reviews. Many users have raised concerns about withdrawal delays, unexpected fees, and issues with account verification.

User AnxiousGuy24 on forexpeacearmy.com: “Since PU Prime is unregulated in the UK, it allowed me to use a leverage of 500:1, which is over 15 times what is allowed in the UK. As a result, I lost more money than I should have. Furthermore, I have seen numerous bad reviews of the broker since. What do I need to say to my bank to initiate a chargeback?”

User DekiTree on reddit.com: “Anyone tried the new PU Prime deposit offer?” – Very mixed replies.

Forex and CFD forums highlight that while some traders appreciate the variety of trading instruments, there are recurring complaints about slippage, widening spreads during news events, and unresponsive customer service. These experiences paint a picture of a broker that might be struggling to maintain the level of service it advertises.

PU Prime FAQs

Verdict on PU Prime: A Broker That Deserves a Closer Look

PU Prime certainly makes a solid first impression. From strong multi-jurisdictional regulation to competitive spreads and a wide selection of trading platforms and instruments, it ticks many of the right boxes. The raw spread ECN options are appealing for cost-conscious traders, and the availability of MT4 and MT5 keeps things familiar and functional.

But not everything is perfect. Some user reviews flag issues around withdrawal speed and pricing execution during volatile conditions. Add to that the lack of a consistent regulatory framework across all regions, and it becomes clear that traders need to check which entity they’re registering under before committing.

In short, PU Prime is a decent choice for experienced traders who know how to manage risk and can look past some of the fine print. For beginners, the lack of educational structure and inconsistent feedback may be reason enough to look elsewhere. It’s a broker that shows promise, but one you’ll want to monitor closely before trusting it with serious capital.