Ox Securities is a forex and CFD broker established in 2013, offering access to major currency pairs, commodities, indices, shares, and cryptocurrencies. It promotes itself as a technology-focused broker with low entry ($0 deposit) and attractive features such as raw spreads and multiple platforms. The broker actively markets to both beginner and experienced traders, offering PAMM accounts and copy trading features for those looking to automate or outsource strategy.

However, a deeper look reveals a less reassuring side. Despite promotional claims around client security and institutional infrastructure, Ox Securities is based offshore, operating under a weak regulatory jurisdiction. For traders prioritising long-term reliability, this alone should be a reason to pause.

Only Trade with Regulated and Reputable Brokers

| Regulated Forex Brokers | Regulated CFD Brokers |

What Ox Securities Has to Offer

Regulation & Security

Ox Securities is registered in St Vincent and the Grenadines, a jurisdiction known for allowing brokers to operate with minimal regulatory oversight. While the company promotes transparency and good practice, such as segregated client accounts and fast execution, its offshore base means traders lack the kind of legal recourse available with top-tier regulators.

There are mentions of ASIC association, which may apply to certain entities under the brand, but for most international clients, the legal footing is thin. No formal investor protection scheme is in place, and disputes may be hard to resolve if things go wrong. In other words, Ox Securities appears to function with some professional standards but without the regulatory backing to fully support them.

Trading Platforms

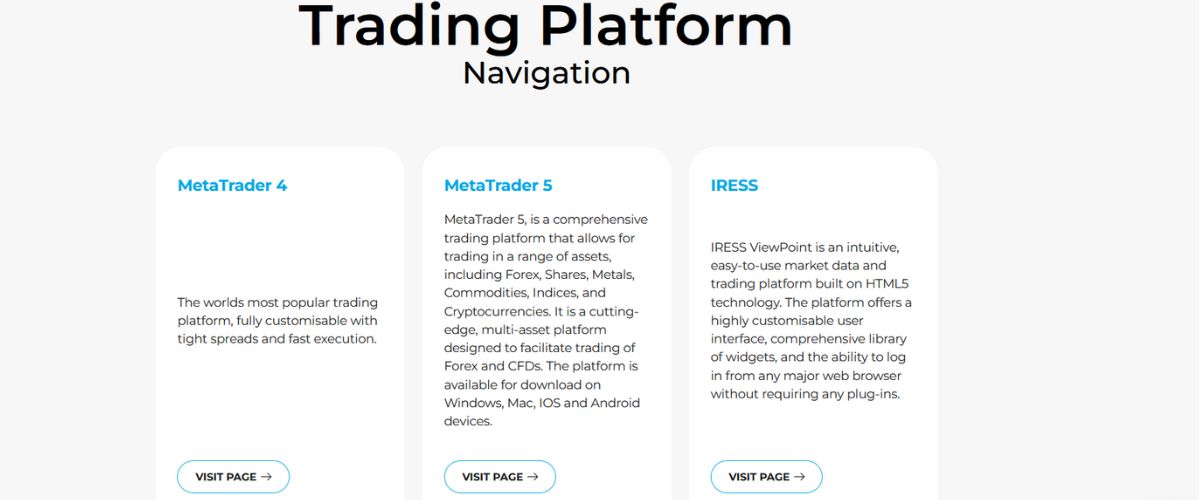

Ox Securities supports three widely used trading platforms, offering flexibility and compatibility across devices:

- MetaTrader 4 (MT4): The most popular retail trading platform, known for its simplicity, custom indicators, Expert Advisors, and strong charting tools.

- MetaTrader 5 (MT5): The upgraded version of MT4, featuring more timeframes, better order management, and depth of market tools.

- IRESS: A professional-grade platform aimed at traders dealing in share CFDs, offering advanced data feeds and direct market access (DMA).

All platforms are accessible via desktop, web, and mobile devices. Server infrastructure is based on Equinix data centres, designed to reduce latency and improve execution times.

Account Types

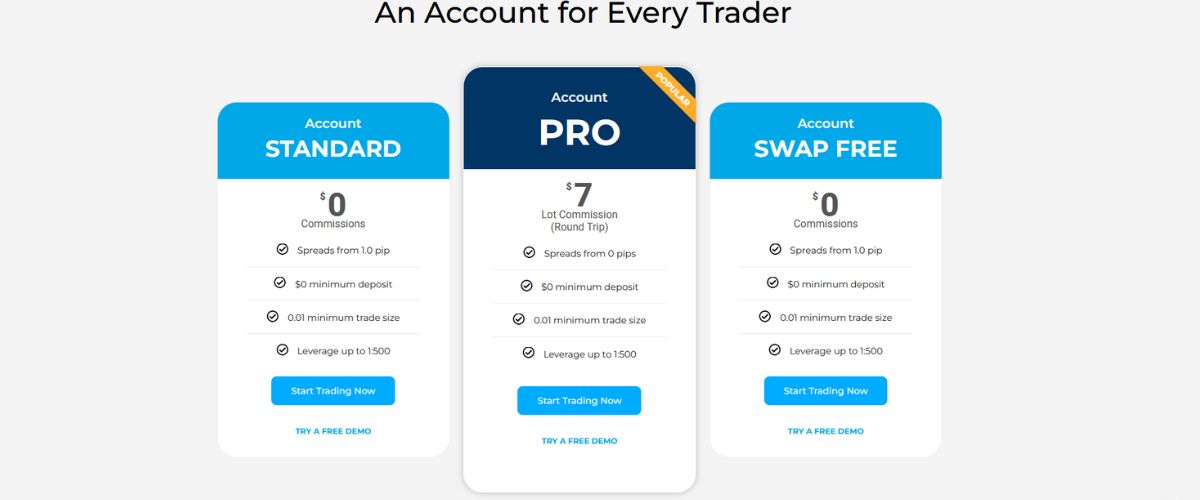

Ox Securities offers a range of account types designed to suit different trader profiles. The structure is straightforward, but caters well to both casual and more advanced traders:

All live accounts come with a $0 minimum deposit requirement and support micro-lot trading (from 0.01 lots). Leverage can go up to 1:500, although this level of exposure should be managed carefully.

Trading Instruments

Ox Securities offers over 140 tradable instruments. These include:

- Major, minor, and exotic forex pairs

- Global stock indices

- Precious metals and energy commodities

- Share CFDs across major markets

- A small but growing number of cryptocurrency CFDs

The product list covers the essentials for most trading strategies, though the number of instruments is modest compared to larger brokers. Those seeking niche markets or a more diversified CFD portfolio might find the offering limited.

Ox Securities Pros and Cons

Pros

Cons

Ox Securities Reviews from the Web

Client feedback is mixed. On the positive side, many traders highlight fast deposits, helpful onboarding support, and good execution on standard trades. Others, however, raise serious concerns, including difficulty withdrawing profits, unexpected account closures, and customer service that becomes less responsive when issues arise. While not every experience is negative, the consistency of certain complaints raises credibility issues that can’t be ignored.

Ox Securities FAQs

What We Learned About Ox Securities

Ox Securities offers some appealing features at first glance such as zero minimum deposit, multiple trading platforms, flexible account types, and the inclusion of copy trading. These qualities make it an accessible choice for beginners or traders who want a simple way to start trading without major upfront costs. Execution infrastructure is sound, and the ability to scale up with raw spread accounts and high leverage can be tempting.

However, the advantages are counterbalanced by serious concerns. The offshore registration leaves traders without meaningful legal protection or access to compensation schemes, and multiple reviews raise red flags about withdrawal delays and inconsistent service. The product range, while sufficient for basic strategies, falls short for those seeking more depth or diversification. The lack of in-house research, educational tools, and transparency only adds to the uncertainty.

In short, Ox Securities may serve a purpose for traders seeking a low-barrier entry point, but it is difficult to recommend for those trading with significant capital or looking for long-term broker reliability. For those individuals, a broker with stronger regulation and a clearer commitment to client trust is a far safer bet.