Proprietary trading, commonly abbreviated as “prop trading”, refers to the practice of trading financial instruments using a firm’s own capital rather than that of clients. The goal is straightforward: generate profits for the firm by leveraging the skill and discretion of selected traders. In recent years, this model has gained traction among independent traders due to the emergence of accessible proprietary trading firms, which offer funded accounts in exchange for a share of the profits generated. This guide explores the mechanics, appeal, and risks of prop trading, offering a foundational understanding for those considering this path.

Prop Trading in a Nutshell

What Is Prop Trading?

A proprietary trading firm, or prop firm, provides traders with access to capital, platforms, and trading conditions in return for a portion of the profits generated. Instead of using personal funds, traders work with the firm’s capital, following a defined set of rules and performance targets. If successful, they retain a share of the profits, often between 70% and 90%while the firm keeps the rest.

The prop trading model is based on a funding-through-evaluation system. Traders start by paying a fee to take part in a trading assessment. The evaluation is not a formality. It tests whether the trader can meet profit targets while adhering to strict risk controls. These evaluations often involve simulated accounts but replicate live market conditions. Passing the evaluation unlocks a funded account, where live trading begins under continued oversight.

This approach appeals to traders who have a working strategy but lack the personal capital required to trade at scale. By removing the capital barrier and limiting the trader’s downside to the evaluation fee, prop firms allow traders to pursue performance-based income while shielding their own funds from risk.

Prop trading can take place across a wide range of markets including forex, commodities, indices, equities, and cryptocurrencies. Some firms allow access to multiple asset classes, while others specialise in one or two. In most cases, trading is conducted remotely via established platforms such as MetaTrader 4, MetaTrader 5, or cTrader.

Prop trading is not employment in the traditional sense. There is no salary, no employee benefits, and no long-term contract. It is a performance-based arrangement where capital is provided conditionally, and access to that capital is maintained only by following firm rules and hitting agreed-upon benchmarks.

How Prop Trading Works

Retail-oriented prop trading firms operate on a performance-based funding model. Traders begin by enrolling in an evaluation process, which typically involves trading a simulated account under live market conditions. The objective is to hit a predefined profit target while staying within strict risk parameters, such as maximum daily losses and overall drawdown limits.

The evaluation structure may vary:

Note: In general, the more stages a trader is required to pass, the lower the evaluation fee and the more lenient the trading conditions. Multi-step evaluations typically offer more flexible risk parameters and lower profit targets compared to instant funding or single-step options.

Only after passing all required stages does the trader qualify for a funded account. At this point, they begin trading real firm capital under continued risk oversight. Live accounts are subject to the same or even stricter rules, including limits on trade size, trading hours, and instruments. Breaches, however minor, can result in account termination or reset.

Traders typically receive a share of the profits they generate, known as a profit split. These splits vary by firm but often range from 70% to 90% in the trader’s favour. Some firms offer biweekly or monthly payouts, contingent on meeting minimum withdrawal thresholds and maintaining rule compliance.

Key to the firm’s model is risk containment. Traders are not risking their own money beyond the initial evaluation fee, but they must adhere to strict guidelines to retain access. These may include:

The firm benefits by scaling only those traders who have proven their ability to manage risk and generate consistent returns. In return, successful traders get access to significantly larger capital than they would typically have on their own, along with a structured environment designed to reinforce discipline.

This model does not offer guaranteed income, and many participants fail to reach the funded stage. However, for disciplined traders with a clear strategy, it offers a scalable and relatively low-cost way to access institutional-level capital without external licensing or client obligations.

In essence, prop trading firms act as gatekeepers, filtering for trading talent through evaluations and incentivising performance through capital access and profit-sharing. The structure is demanding, but for the right type of trader, it represents a viable pathway to professional trading.

Examples of Evaluation Phases

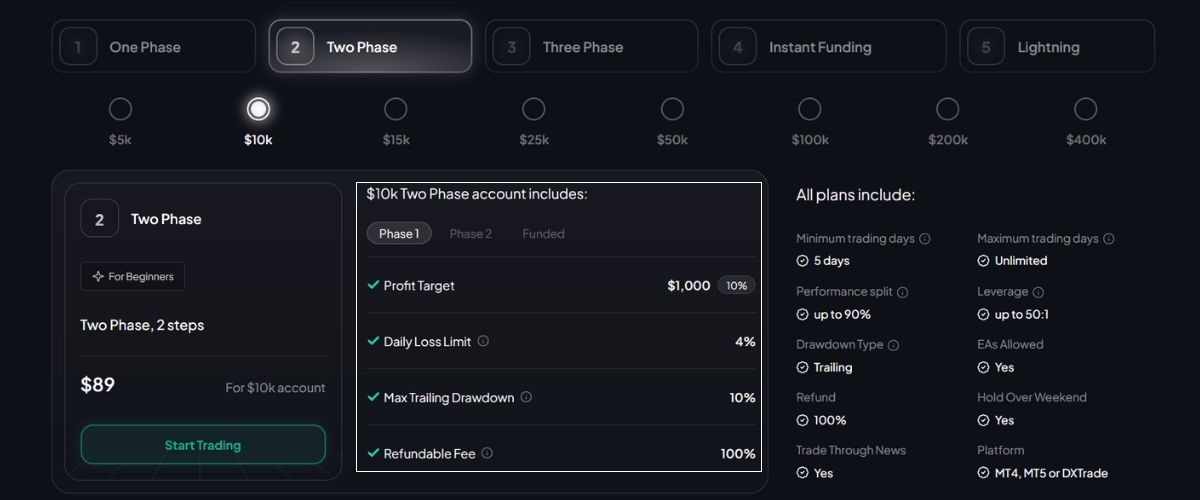

Two-Phase Evaluation: Phase1 With FXIFY

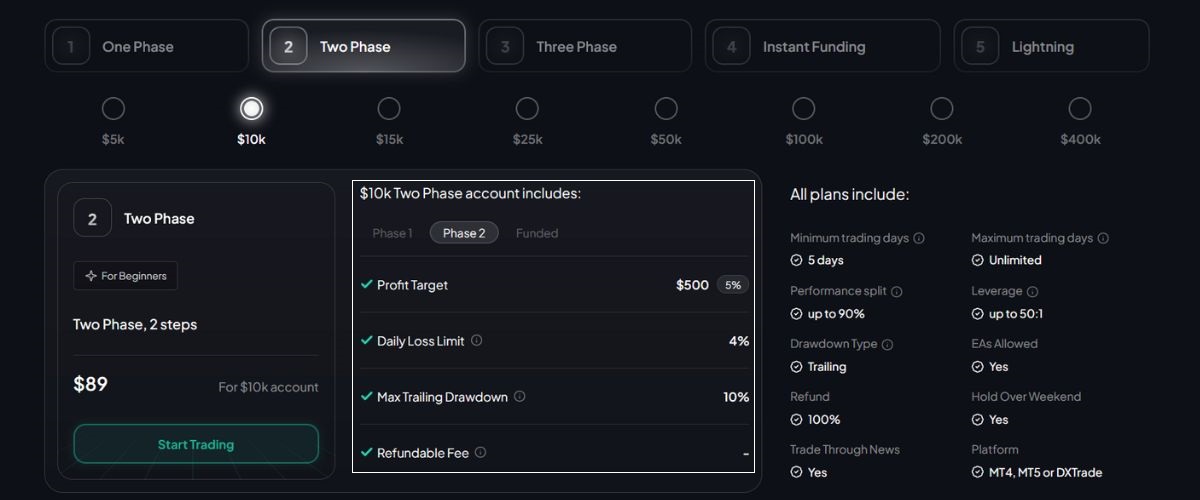

Two-Phase Evaluation: Phase2 With FXIFY

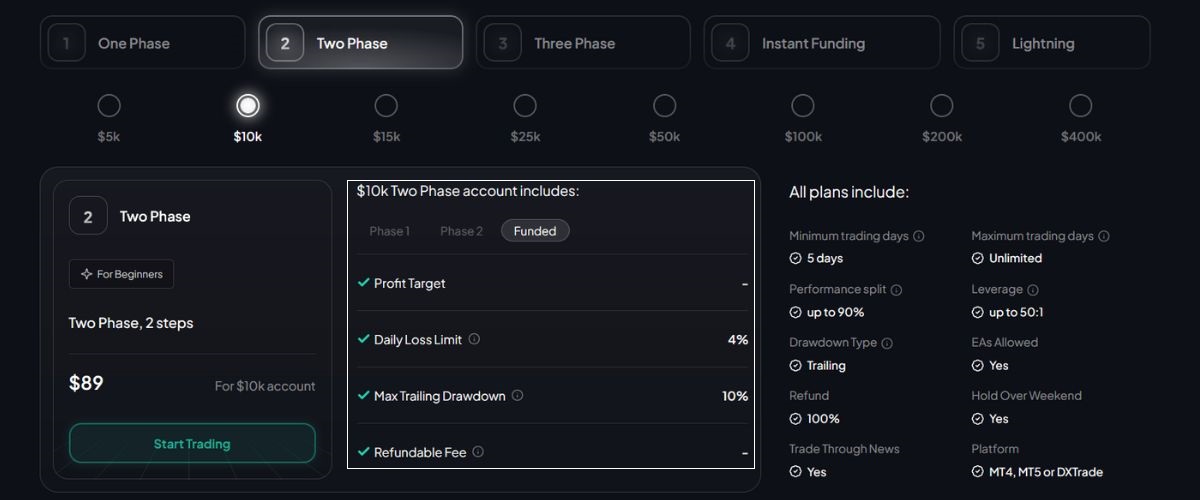

Two-Phase Evaluation: Phase Funded With FXIFY

Risks Associated with Prop Trading

Although prop trading offers potential rewards, it also comes with significant risks that should be understood clearly before engaging. These include:

Understanding these risks is essential for responsible participation in any prop trading program. Prospective traders should approach with caution, perform due diligence on the firm’s credibility, and ensure their strategy is well-tested before committing capital or time.

Pros and Cons of Prop Trading

Pros

Cons

Frequently Asked Questions (FAQs)

What You Need to Know About Prop Trading

Prop trading presents a compelling opportunity for skilled traders seeking to scale their strategies with firm capital. Its structured format and merit-based rewards appeal to those with a tested edge and strong risk discipline.

However, this path is not without its challenges. Strict rules, psychological demands, and lack of regulatory safety nets make it unsuitable for beginners or those without a well-defined plan. The evaluation process acts as both a filter and a training ground, reinforcing the principles necessary for long-term success.

For traders prepared to treat it as a professional endeavour, proprietary trading offers a viable and scalable route into capital markets—without the need to take on client assets or build personal portfolios from scratch.