OQtima is one of the many new names to enter the CFD space, branding itself as a modern, trader-first broker with advanced platforms and a wide range of markets. At first glance, it seems to tick the right boxes: MetaTrader support, over 1,000 instruments, and competitive pricing.

But once you start peeling back the layers, things get a little less impressive. The broker claims to be a global operation, yet lacks proper regulation from the FCA. There’s no cTrader support as previously implied, and transparency is noticeably lacking in some key areas. So while the front-end looks polished, there are questions that deserve closer inspection.

Only Trade with Regulated and Reputable Brokers

| Regulated Forex Brokers | Regulated CFD Brokers |

What OQtima Has to Offer

Regulation and Safety

Only OQtima EU Ltd is authorised and regulated by CySEC (Cyprus) and passported across the EEA. Only Seychelles FSA for OQtima INT LTD means less stringent regulations and no compensation scheme. As a result, traders rely more on the broker’s internal policies, which, without third-party enforcement, may provide less security compared to EU-regulated frameworks.

OQtima EU Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) and onboards only European-area clients.

OQtima INT Ltd is authorised and regulated by the Seychelles Financial Services Authority (FSA) and, under that licence, advertises leverage up to 1,000:1.

Important to know before choosing the Seychelles entity (OQtima INT Ltd):

- You would not be eligible for compensation under CySEC’s Investor Compensation Fund (ICF).

- The Seychelles FSA does not require by law negative-balance protection (NBP); OQtima INT Ltd offers Negative Balance Protection on their website as per their internal policy.

- The Seychelles regime offers no government-backed compensation scheme comparable to either CySEC’s ICF or the UK’s Financial Services Compensation Scheme (FSCS).

High leverage can amplify both gains and losses. Make sure you understand the risks and the level of regulatory protection you will (and won’t) have before trading.

Trading Platforms

OQtima sticks to the MetaTrader suite, which is a smart move. It offers:

There is no cTrader offered, despite what some online chatter may suggest. That narrows the appeal a bit for those used to ECN-style depth and execution transparency. Still, MT4 and MT5 are industry standards and should suffice for most discretionary traders.

Platforms are available on desktop, web, and mobile, with no complaints there.

Account Types

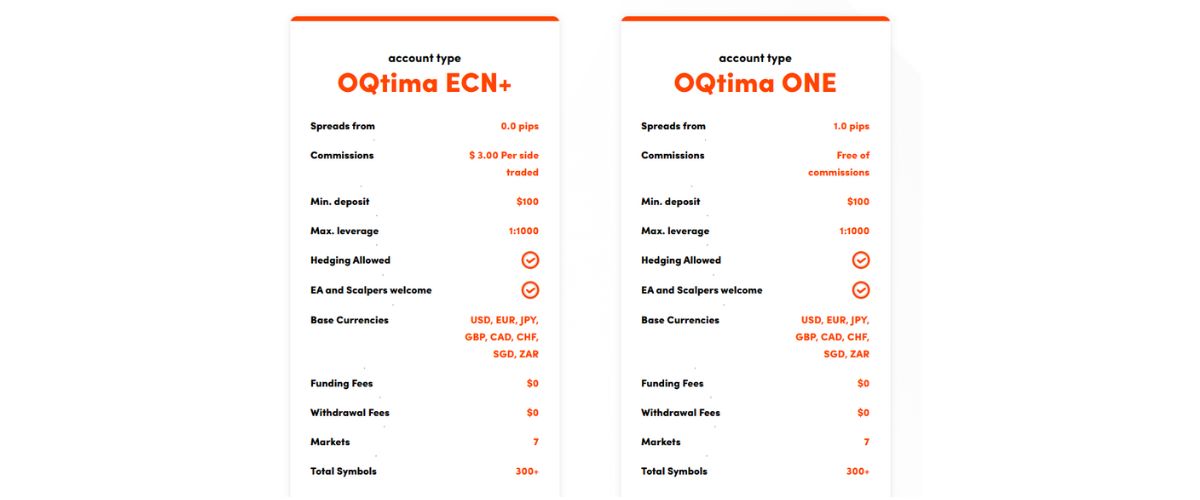

OQtima keeps its offering streamlined with a focus on flexibility and accessibility. Traders can choose between three core account types, each suited to different trading styles and levels of experience:

All account types require a minimum deposit of $100 and allow for scalping, hedging, and Expert Advisor (EA) usage.

Markets and Instruments

Despite being a newer name, OQtima offers an impressive range of tradable assets:

- Forex: A solid mix of majors, minors, and exotics

- Indices: Global benchmarks including S&P 500, DAX, FTSE, and others

- Commodities: Gold, silver, oil, and more

- Stocks: CFDs on a selection of international equities

- Cryptocurrencies: BTC, ETH, and a few others via CFDs

- ETFs: A modest offering for broader diversification

Over 1,000 instruments are available in total, giving traders the flexibility to move across asset classes and adjust to different market conditions. The range is respectable and more than enough for most.

Fees and Spreads

This is one area where OQtima tries to stand out. Here’s the breakdown:

There are no deposit or withdrawal fees imposed by OQtima, which is good to see.

Trading Tools

OQtima has gone beyond the usual economic calendar and pip calculators. Their platform includes a set of integrated tools designed to help traders analyse markets, identify opportunities, and stay informed, all without needing third-party add-ons. It’s not an overloaded suite, but what’s included is practical and focused.

All tools are accessible directly through the client dashboard, with no extra logins or third-party platforms required. Whether you’re a chart-heavy technical trader or someone who likes to blend fundamentals with momentum, OQtima gives you enough to work with, even if it’s not the most extensive toolkit out there.

OQtima Pros and Cons

Pros

Cons

OQtima Reviews from the Web

Being a newer broker, there’s not a huge trail of user reviews yet. What’s out there is a mix.

There’s no real educational hub to speak of. If you’re expecting structured training or webinars, you won’t find much beyond generic guides. This broker is clearly focused on traders who already know what they’re doing.

OQtima: What We Learned

OQtima presents itself as a sleek and modern trading platform with attractive conditions, but once you look beyond the surface, the core issue becomes hard to ignore. This is a broker operating in a highly competitive space, relying heavily on aggressive pricing and high leverage to attract attention.

If you’re an experienced trader who fully understands the risks involved and simply wants access to raw spreads through MT4 or MT5, then OQtima might meet your needs. However, if your priorities include long-term stability, regulatory protection, and clear safeguards, this broker may not be the right fit.

Right now, OQtima shows potential, but it remains untested. And in this industry, potential alone doesn’t guarantee trust.