Unregulated Broker, Be Cautious When Trading with JustMarkets

In the ever-competitive world of online trading, JustMarkets is one of those brokers that often comes up in discussions for all the right reasons, and occasionally, for the wrong ones. Founded back in 2012, JustMarkets offers access to a solid selection of markets, competitive pricing structures, and a variety of account types to suit just about any trader. But does it actually live up to the expectations, or is it just another broker riding the wave of flashy marketing? Let’s break it down.

Only Trade with Regulated and Reputable Brokers

| Regulated Forex Brokers | Regulated CFD Brokers |

What JustMarkets Has to Offer

Regulation and Safety

JustMarkets is regulated by the Financial Services Authority (FSA) of Seychelles. While it’s not a Tier-1 regulator like the FCA or ASIC, the FSA still provides a basic framework for compliance, client fund segregation, and operational standards. Traders should be aware, however, that protections like investor compensation schemes or strict dispute mechanisms are not on par with EU or UK standards.

The broker emphasises data security and uses segregated accounts to hold client funds, meaning your money is kept separate from operational capital — a good industry practice. Still, without tighter oversight, users should approach with a balanced mindset: the structure is solid, but it’s not bulletproof.

Trading Platforms

JustMarkets sticks to the classics, MetaTrader 4 and MetaTrader 5, and for good reason. These platforms are trusted by millions of traders around the world and offer a dependable, customisable trading environment:

Both platforms are available on desktop, web, and mobile, which means you can trade whenever and wherever it suits you. Execution is generally fast, and the connection with JustMarkets’ servers is stable enough for scalpers and day traders alike.

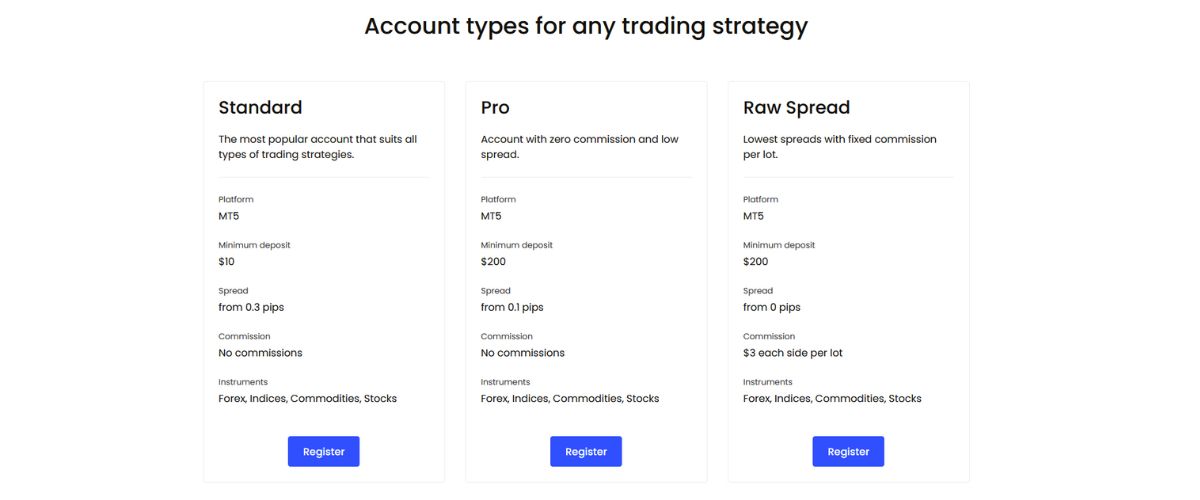

Account Types

JustMarkets offers a range of accounts to suit different trader needs — from absolute beginners to high-frequency, experienced pros:

Overall, the account options are logical, flexible, and scale well with your trading journey.

Markets and Instruments

JustMarkets covers all the essential asset classes, giving traders the tools to diversify their portfolio without overwhelming them with clutter:

If your trading strategy involves cross-asset diversification, JustMarkets covers most bases. It’s not exhaustive, but it is purposeful.

Fees and Spreads

One of the most appealing aspects of JustMarkets is how straightforward and competitive its fee structure is. There are no surprises, no gimmicks, just clean pricing:

There are no deposit fees. Withdrawal fees depend on your method but are generally reasonable. And best of all — no inactivity fees. That’s rare these days and makes JustMarkets more accommodating for part-time or seasonal traders.

Deposit and Withdrawal Options

JustMarkets offers a flexible range of deposit and withdrawal methods, tailored for global accessibility:

Funding is mostly fee-free on the broker’s end. Most methods are processed instantly or within a few hours. The wide range of options, especially crypto, makes it easy for traders across different regions to access and manage their accounts efficiently.

JustMarkets Pros and Cons

Pros

Cons

JustMarkets’ Reviews from the Web

JustMarkets Reviews on Reviews.io: “I want to share my negative experience with an investment platform that had serious security issues, which unfortunately led to my funds being stolen. To make matters worse, their customer support was completely unhelpful.”

Justmarket broker from BabiPips: “My only experience of it is reading its online reviews just now (because you asked!). Many are hair-raisingly awful, and made me want to run a mile.”

Justmarkets eat my all profit and accused me of fraudulent trading on FPA: “I am writing to provide my experience of the services provided by Justmarkets.com Broker. I opened an account with Justmarkets.com with the MT5 A/C No. 2000624085. I would like to bring to your attention an incident that has occurred with my account, which has led me to believe that Justmarkets.com is a fraudulent broker.”

Final Verdict: Is JustMarkets the Right Fit for You?

JustMarkets gets a lot of things right — low entry barriers, flexible account options, clean spreads, and support for both MetaTrader platforms. For traders who appreciate simplicity, affordability, and practical tools without the bells and whistles, this broker delivers a strong, no-frills experience.

That said, it’s not a one-size-fits-all solution. Regulation is light, and traders looking for comprehensive stock or altcoin exposure might find the offering too narrow. There’s also no proprietary platform, which some traders might miss.

Still, if you’re a beginner looking to get started with minimal capital or a cost-conscious trader who knows exactly what you need, JustMarkets checks a lot of boxes. It’s easy to set up, easy to scale with, and focused on getting you into the market — without excessive distractions or costs.