FXIFY is a proprietary trading firm offering funded accounts to retail traders in exchange for a share of generated profits. Similar to other prop firms operating in this space, FXIFY positions itself as an alternative pathway for individuals lacking large capital bases but possessing technical skill and discipline. While the model holds clear appeal, especially for aspiring professionals, there are concerns surrounding transparency and operational clarity that temper the attractiveness of this offering. This review dissects FXIFY’s operations, compensation structure, platform access, and overall legitimacy to inform whether it presents a worthwhile opportunity for experienced traders.

How FXIFY Works and Operates

FXIFY offers traders the opportunity to manage significant capital by passing an evaluation process. This process involves one, two, or three stages, depending on the chosen track. Each stage is structured to test consistency, risk control, and trading skill under specific constraints. Upon successful completion, traders are granted access to a funded account and retain a portion of the profits generated through their trades.

While the firm previously centred its offerings around a two-phase model (Evaluation and Verification), the updated structure allows greater flexibility. Each stage includes specific targets for profit, maximum daily loss, and overall drawdown.

Leverage across FXIFY accounts is typically set at 1:50, which is moderate by proprietary firm standards. While it still offers meaningful exposure, this leverage level may temper risk-taking behaviour, especially for those accustomed to higher ratios. Effective risk management remains essential to avoid breaching loss limits.

Available Platforms and Markets on FXIFY

FXIFY provides access to both MetaTrader 4 and MetaTrader 5 platforms. These platforms are widely adopted across the trading industry due to their stability, advanced charting tools, and compatibility with automated strategies. Traders can operate in a broad range of financial markets, including:

- Major and minor forex currency pairs

- Stock indices (such as the S&P 500, NASDAQ, and FTSE)

- Precious metals and energy commodities (e.g., gold, silver, oil)

- Cryptocurrencies (e.g., Bitcoin, Ethereum, and others depending on availability)

Order execution is routed via liquidity providers using a raw-spread model with added commissions. The specific execution partners or brokers remain undisclosed, which limits transparency in trade routing and slippage conditions.

FXIFY Plans, Fees, and Payout Structure

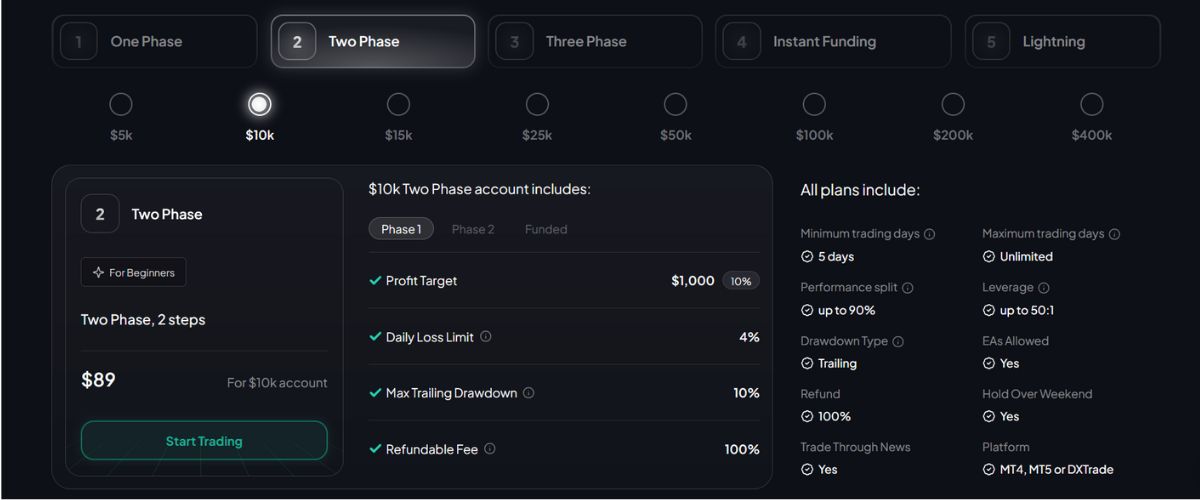

FXIFY offers various account sizes, each with its own set of conditions. Below is a general representation of the core two-step evaluation plan offerings (note: these figures apply specifically to the two-stage evaluation model):

| Account Size | Evaluation Fee (One-time) | Profit Target | Max Daily Loss | Max Drawdown | Profit Split |

|---|---|---|---|---|---|

| $10,000 | $89 | 10% | 4% | 10% | Up to 90% |

| $50,000 | $379 | 10% | 4% | 10% | Up to 90% |

| $100,000 | $549 | 10% | 4% | 10% | Up to 90% |

| $200,000 | $1,049 | 10% | 4% | 10% | Up to 90% |

Fees are paid upfront and non-refundable. In return, the trader gains access to the evaluation platform and, if successful, transitions to a funded account. The payout frequency is bi-weekly, with traders eligible for withdrawals once they begin live trading. FXIFY states that profit splits can reach up to 90%, although this is typically reserved for traders who demonstrate consistent performance and longevity with the platform.

One notable aspect is that the firm does not charge ongoing subscription fees after the initial evaluation cost. However, repeat attempts following failure will require additional payments. Refunds of the initial evaluation fee are sometimes offered after meeting specific profitability milestones, although these policies vary and should be confirmed before committing capital.

Two-Stage Evaluation for $10K Account

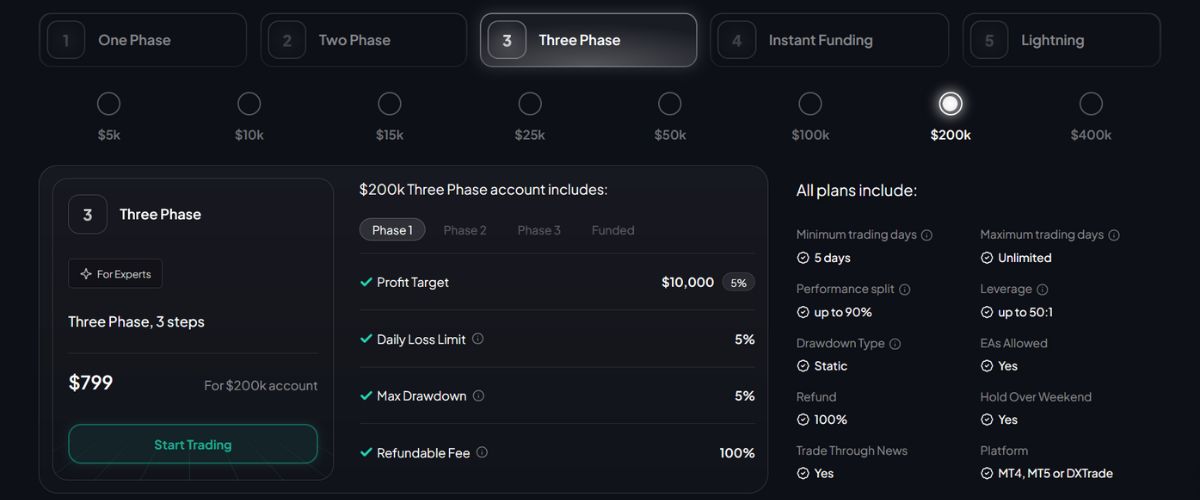

Three-Stage Evaluation for $200K Account

FXIFY offers multiple evaluation structures, each designed to accommodate different trader profiles and preferences. The key models are:

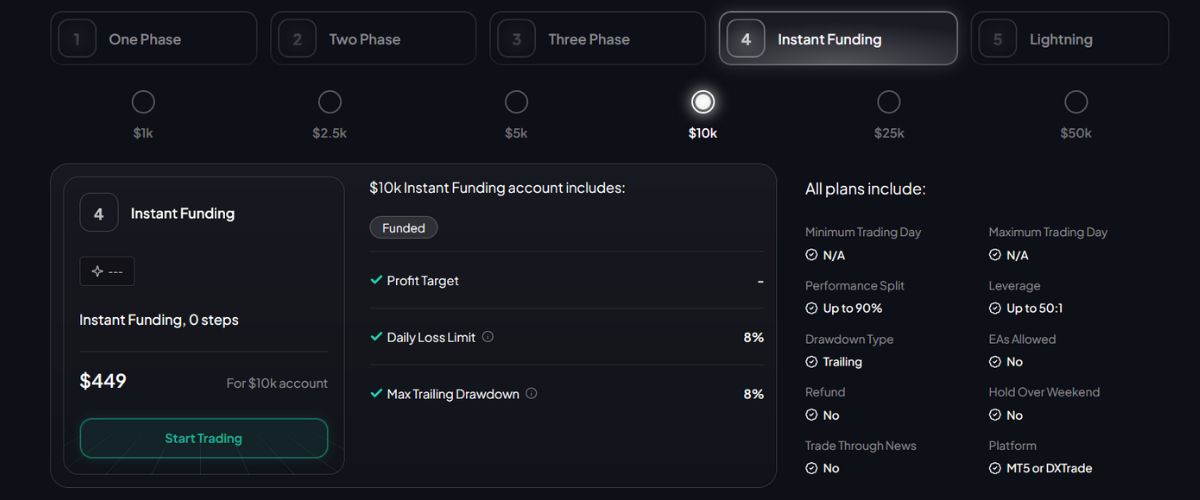

FXIFY Instant Funding: A Premium Path for Traders

FXIFY offers an instant funding model that stands apart from the standard multi-stage evaluation systems used by most prop firms. Under this structure, traders gain immediate access to live capital without undergoing any performance trials. While this convenience comes at a significantly higher cost, it removes the uncertainty and delay associated with evaluation stages.

Instant Funding for $10K Account

Despite being the most expensive option available, FXIFY’s instant funding model has emerged as the preferred choice among many traders. The appeal lies in its simplicity and speed: qualified individuals can begin live trading with firm capital almost immediately. For traders confident in their strategy and risk management, the premium is justified by the opportunity to bypass testing and start generating profit shares right away.

FXIFY Pros and Cons

Pros

Cons

FXIFY FAQs

Everything You Need to Know About FXIFY

FXIFY offers a relatively accessible model for traders aiming to secure institutional-style capital without risking their own savings beyond a fixed entry cost. The availability of large account sizes, moderate leverage, and competitive payout ratios presents clear advantages for disciplined and skilled participants. However, opaque operational structures, limited execution transparency, and the absence of external oversight introduce meaningful counterparty risk.

For professional traders accustomed to clearly defined compliance procedures and reliable escalation channels, FXIFY may fall short of expectations. While it could serve as a short-term opportunity for those with tactical trading acumen and high-risk tolerance, reliance on such a platform for long-term career development is questionable. In an industry where structure and transparency are essential, FXIFY leaves too many critical elements unclear to fully endorse its offering without reservation.