Most people hear the phrase funds recovery company only after they have already lost money to a scam broker or a fraudulent online platform. At that point, they are stressed, desperate and searching for anyone who claims they can help. The problem is that this desperation is exactly what many so-called recovery firms rely on. They know your guard is already down, and they use that moment to sell hope that usually leads to more losses.

Before diving in, it is important to recognise that genuine dispute resolution does exist, but it never comes through cold emails, social media messages or third-party companies promising fast results. The images above show how these outfits spam legitimate business listings with obviously suspicious praise, usually trying to pull in victims who are already struggling. Understanding how these companies work is the best way to avoid being caught twice.

What Funds Recovery Companies Claim to Do

These companies present themselves as specialists who can retrieve money lost to scams. On paper, they sound helpful. They advertise services like:

To someone who has just lost savings, this looks reassuring. They use confident language, official sounding names, and often display badges or logos that suggest authority. Many victims only realise later that these companies have no link to banks, regulators or law enforcement.

What They Actually Do

In reality, most of these recovery companies rely on very simple tactics that target people in a vulnerable state. Their whole operation revolves around one thing, convincing you that they have more power than they do. A typical pattern looks like this:

The positive comments placed under your business listing show exactly how they operate. They flood public review sites with scripted messages that all follow the same format. The goal is to appear credible to someone who is not familiar with these tactics. They never mention real case numbers, real timelines or real processes because none of those things exist behind the scenes.

Most of these companies cannot recover anything for a very simple reason. When money is gone from an unregulated broker or a crypto scheme, the only entities with the authority to pursue it are banks, regulators or legal bodies. A private firm with no official status cannot force a scammer to comply.

How They Scam Victims Again

The sad truth is that many people fall victim twice. First, they lose money to a fraudulent broker or online scheme. Then, while searching for help, they are targeted again by companies that claim they can recover the lost funds. These firms often appear credible on the surface, but their methods follow a predictable pattern once you know what to look for.

Why They Target Broker Review Sites

The images you provided show how they take advantage of public spaces where traders look for answers. Review platforms are filled with genuine users trying to warn others, and these companies bury those warnings under their own posts. There is a clear pattern:

It is a form of advertising aimed at people in distress. They know victims searching for the name of a broker they lost money to may stumble across these reviews, so they place their bait exactly where that audience will be.

How Recovery Scammers Used Fake Reviews on Independent Investor

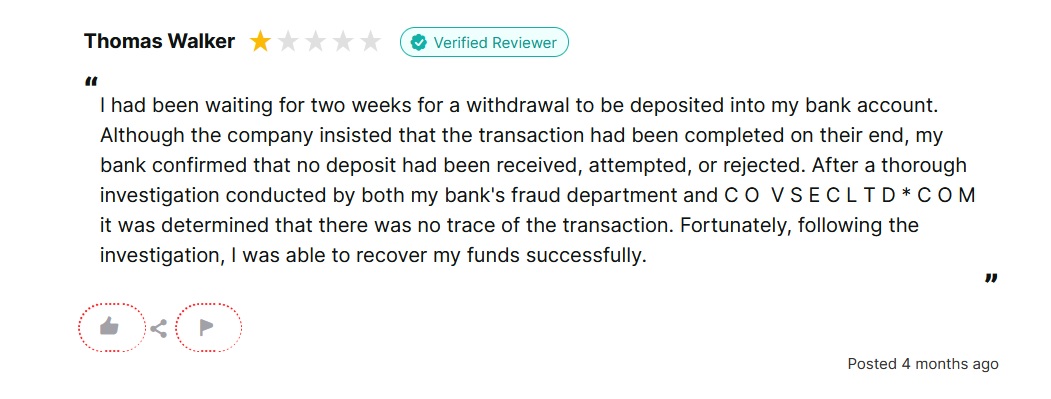

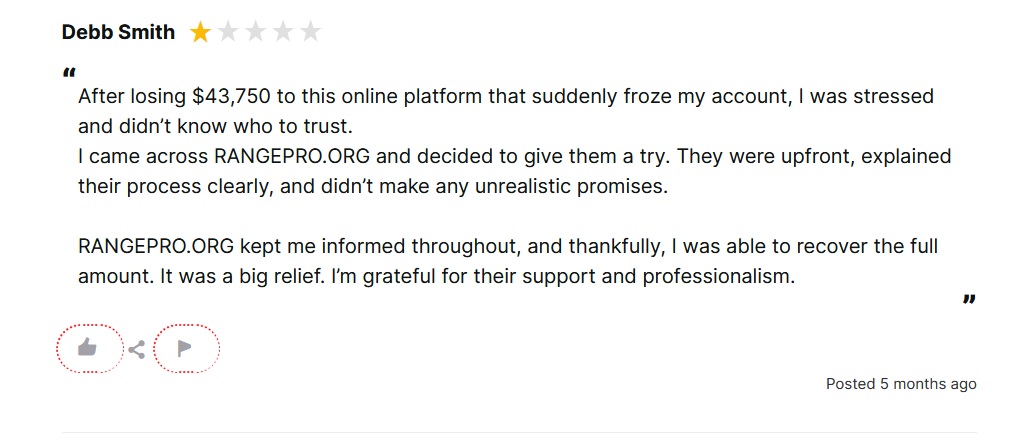

While researching funds recovery firms for this article, we reviewed platforms like Trustpilot, Reviews.io, and Sitejabber. What we found on Reviews.io was alarming. Many of the reviews appeared to be fake or misleading, often written in a formulaic style with exaggerated claims of success. These reviews typically praised obscure recovery websites, using emotionally charged language to build trust and legitimacy.

Some examples are shown below. It mimics the tone of a genuine testimonial but raises red flags: vague details, generic praise, and a suspiciously positive outcome. These kinds of reviews are often part of a broader strategy to lure in victims who have already lost money, giving them false hope and pushing them toward yet another scam.

* The reviews shown above were flagged as suspicious and have since been reported and removed.

* IndependentInvestor.com has never requested, accepted, or processed payments from visitors. We do not offer recovery services or financial transactions of any kind.

Why Real Recovery Does Not Work This Way

If you have been scammed, the only bodies that can intervene are the ones with legal authority or direct responsibility for financial conduct. These include:

None of these will contact you out of the blue. None of them advertise through generic review comments. None of them need upfront fees to “start your case”. They follow a process based on evidence and regulation, not emotional persuasion.

What You Should Do Instead

If you lost funds to a scam broker or fraudulent platform, the safest options are always the official ones. Before you speak to any private company online, take these steps:

These steps do not guarantee recovery, but they place you in the hands of entities that actually have the authority to investigate.

Final Thoughts: Protect Yourself From the Second Scam

Falling victim to a scam broker is painful enough. Recovery companies prey on that frustration by pretending to fix the problem, but they rarely do anything except create new losses. The posts placed under your business listing are a clear example of how these companies operate. They use generic praise to appear trustworthy and hope that desperate victims will reach out.

If you want the best chance of recovering money or at least reporting the fraud properly, always use official channels. Banks, regulators and ombudsman services might take longer, but they are the only institutions with the power to act. Avoid anyone promising quick results, guaranteed outcomes or personalised recovery plans. They are selling a service that simply does not exist.