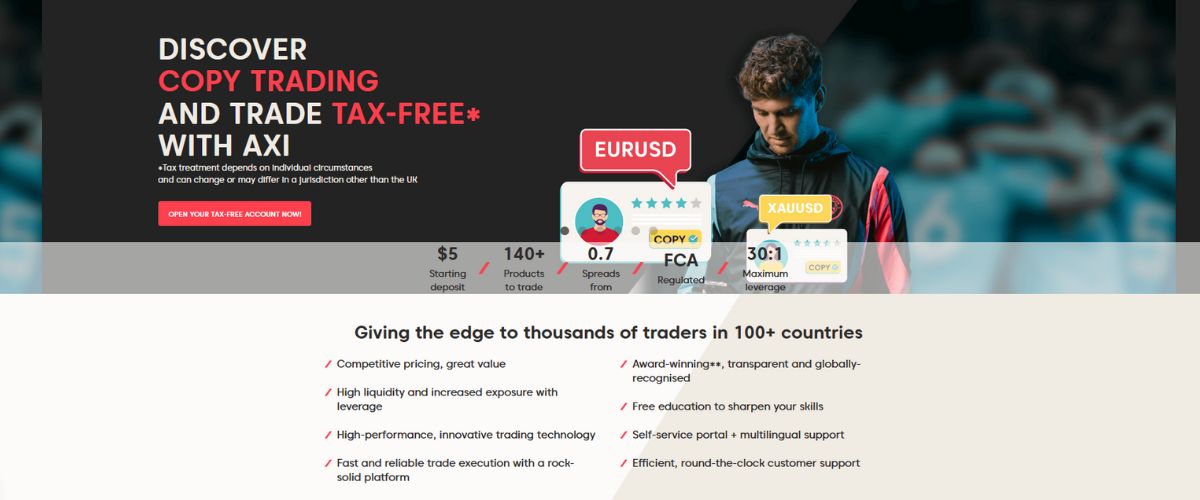

Axi, previously known as AxiTrader, is a forex and CFD brokerage established in 2007. Prominently regulated by reputable bodies such as the Financial Conduct Authority (FCA) in the UK and ASIC in Australia, it provides robust oversight and comprehensive client protections. Despite its credibility, traders should be aware that its spreads can be wider than those offered by some competitors, potentially affecting trading costs.

What Axi Has to Offer

Regulation and Security

Axi maintains strong regulatory oversight through two highly respected financial authorities, the FCA in the UK and ASIC in Australia. This dual regulatory structure ensures that client funds are securely segregated from the broker’s own funds, providing significant protection against misuse. Additionally, traders in the UK benefit from the Financial Services Compensation Scheme (FSCS), covering client deposits up to £85,000. Such measures significantly enhance confidence in Axi’s operational stability and its commitment to client safety.

Trading Platforms

Axi primarily offers access to the popular MetaTrader 4 (MT4) platform, renowned globally for its reliability, user-friendly interface, and extensive technical analysis capabilities. Traders benefit from a range of sophisticated tools, including customisable charts, advanced order types, and automated trading through Expert Advisors. To further enhance its offering, Axi supplements MT4 with useful analytical tools such as AutoChartist, providing traders with actionable market insights, and MT4 NexGen, adding extra trading functionalities and efficiency improvements to the standard MT4 experience.

Account Types

Axi provides traders with two main account options to suit different trading preferences:

- Standard Account: This account type offers commission-free trading, which might appeal to beginners or traders who prefer a simpler fee structure. However, spreads tend to be wider compared to the Pro Account, potentially increasing overall trading costs.

- Pro Account: Designed for more active traders, the Pro Account offers tighter raw spreads, making it ideal for those who trade frequently or in larger volumes. This benefit is offset by a modest commission per trade, which traders must factor into their overall cost analysis.

Both account types have a minimum deposit requirement of just $5, making them accessible to traders with various levels of initial capital.

Trading Instruments

Axi provides traders access to a selective yet practical range of just over 140 markets. This includes numerous forex pairs, commodities, major global indices, and equity CFDs. While the selection is relatively limited compared to brokers offering wider market access, the curated selection does include popular and actively traded assets, suitable for traders who prefer focusing on key market segments without unnecessary complexity.

Axi Pros and Cons

Pros

Cons

Axi Reviews from the Web

GIULIANO from TrustPilot: “I’ve had a truly positive experience with this broker. The Axi Select program is definitely a highlight; it’s well-structured and provides a clear path for traders looking to scale”

RantaMin from Elitetrader: “If you’ve ever used the Axi Select program or know someone who has, I would greatly appreciate hearing your thoughts and experiences. Please, if possible, share your feedback and reviews about this program.”

nacirmalik from ForexPeaceArmy: “I am using deposit and withdrawal through skrill only now company force me to withdrawal only and only through bank.

It is very much annoying to me as I file a support ticket to company on 9 Aug and on 10 Aug they give me only option of bank withdrawal which I never use for deposit or withdrawal.”

Netsoft24 from Reddit: “However, a quick search here reveals not much information about this broker. If anyone has used them before, care to share your experience?”

Axi FAQs

What We Learned About Axi

Axi delivers a secure and accessible trading environment, anchored by strong FCA and ASIC regulation and the reliability of the MT4 platform. Its tools, copy‑trading options, and low minimum deposit enhance its appeal, especially to beginners or those trading mainstream markets.

However, traders should note wider spreads on its Standard account and a limited market portfolio—just over 140 instruments—relative to larger brokers. The absence of MT5 or cTrader may also limit technical and automated trading capabilities. Real‑world feedback underscores both solid execution and occasional customer support delays.

In short, Axi is a reliable, well‑regulated broker ideal for core forex and CFD trading, especially for those starting with limited capital. But for traders seeking broader market access, tighter cost control, or multiple platform choices, alternatives may offer a better fit.