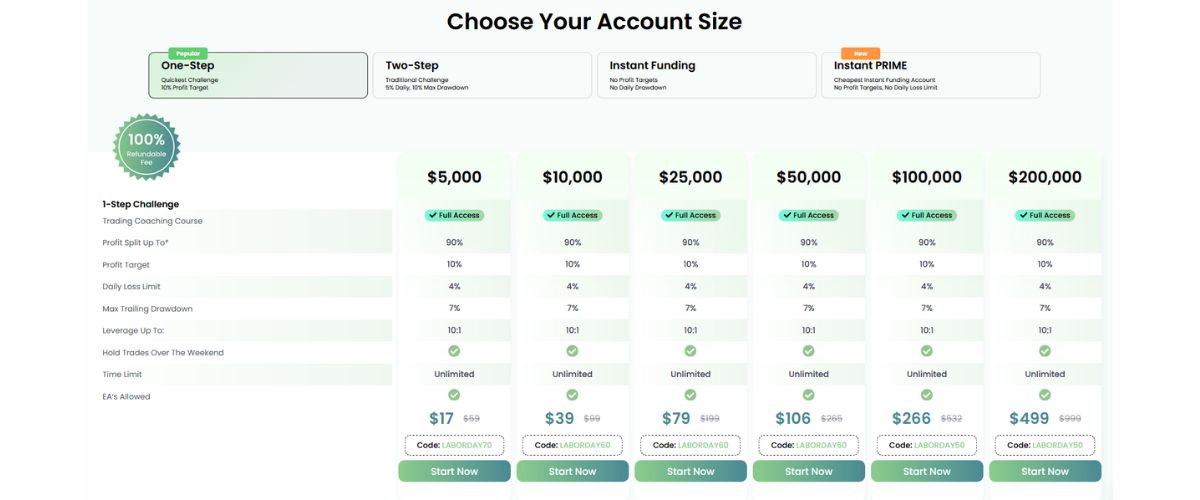

Top One Trader is a proprietary trading firm that provides traders with access to funded accounts through structured challenges. The company markets itself as a cost-effective way for traders to scale strategies without risking significant amounts of personal capital. With fees starting as low as $17 for a $5,000 account, it is among the most affordable entry points in the prop trading space.

Like all prop firms, the structure is performance-driven. Traders must meet profit targets while adhering to strict risk management rules to qualify for funded accounts. In return, they receive a share of profits, often starting at 80 percent and increasing with consistent performance. This review examines how Top One Trader works, the account structures available, and whether its offering stands out in an increasingly crowded prop firm market.

How Top One Trader Works and Operates

Top One Trader follows the standard proprietary trading model: traders pay a one-time fee to enter an evaluation designed to test profitability and discipline. Those who meet the required targets within defined drawdown limits progress to a funded account, where they share profits with the firm.

The evaluation process is available in both One Phase and Two Phase structures. The One Phase model requires traders to meet a single profit target without violating rules, while the Two Phase structure spreads objectives over two stages, lowering targets at each stage but requiring consistency over time. Both models are designed to identify traders who can balance opportunity with risk management.

A defining feature of Top One Trader is accessibility. With accounts starting at just $17, traders can enter the evaluation process at a fraction of the cost compared to many competitors. This affordability makes the firm appealing not only to experienced traders but also to those who want to test their strategies with minimal upfront commitment.

Once funded, traders are eligible for payouts within two weeks of starting live trading. Profit splits begin at 80 percent and may increase to 90 percent or higher for those who demonstrate consistency.

Available Platforms and Markets on Top One Trader

Top One Trader gives traders access to a broad selection of platforms, catering to different preferences and trading styles. The firm supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), long considered industry standards for their advanced charting, technical tools, and compatibility with automated strategies through Expert Advisors (EAs).

In addition, traders can choose cTrader, a platform favoured for its clean interface, fast execution speeds, and strong support for algorithmic trading. Match Trader is also available, offering an integrated environment that combines order execution with built-in analytics and social trading functions. For those seeking a modern, user-friendly option, TradeLocker provides a streamlined web-based platform with mobile accessibility and multi-asset support.

This range of platforms ensures that traders are not limited to a single system. Whether they prefer the familiarity of MetaTrader, the precision of cTrader, or the flexibility of Match Trader and TradeLocker, Top One Trader accommodates a wide variety of approaches.

The range of tradable markets is competitive and includes:

- Forex: Access to major, minor, and some exotic pairs.

- Indices: Global benchmarks such as NAS100, SPX500, US30, and GER40.

- Commodities: Key energy assets like crude oil and natural gas.

- Metals: Precious metals including gold and silver.

- Cryptocurrencies: Popular digital assets such as Bitcoin and Ethereum, usually offered with lower leverage to control volatility.

This breadth ensures flexibility for different strategies, whether short-term scalping, swing trading, or longer-term positional trading.

Top One Trader Plans, Fees, and Payout Structure

Top One Trader offers a wide range of account types to suit different trader profiles. Whether you are looking for a low-cost entry into prop trading, a more gradual evaluation process, or direct access to instant funding, the firm provides options that balance affordability, flexibility, and scale.

One-Step Challenge Fees and Requirements for Top One Trader

Top One Trader Pros and Cons

Pros

Cons

Top One Trader FAQs

What You Need to Know About Top One Trader

Top One Trader distinguishes itself with affordability, making it one of the easiest firms to access financially. With entry costs as low as $17, it lowers the barrier for traders who want to test their strategies without risking large sums of personal capital. Coupled with competitive profit splits, early payout eligibility, and strong platform support, the firm delivers an appealing value proposition.

That said, success still requires discipline. The strict enforcement of drawdown rules, modest scalability compared to some peers, and reliance on firm stability mean that only traders with proven consistency are likely to succeed. Beginners may find the rules unforgiving, regardless of the low entry fee.

In summary, Top One Trader offers a cost-effective route to firm-backed trading, but it is no shortcut to success. Traders who are disciplined, consistent, and comfortable with structured risk management may find it a practical partner. Those still refining their skills may struggle to maintain accounts under such strict conditions.